Johnson & Johnson (NYSE: JNJ), Dow (NYSE: DOW), and Chevron (NYSE: CVX) are three of the highest-yielding stocks in the index. Investing $2,500 into each stock produces an average yield of 4.2% and should generate at least $300 in passive income per year. Here’s why all three dividend stocks are worth buying now.

Investing in dividend-paying stocks can be one of the smartest ways to generate passive income. For many, it’s a pathway to financial independence, providing steady cash flow with relatively low maintenance. But to truly enjoy the benefits, choosing the right stocks is critical. This article explores the top dividend stocks for steady income, focusing on proven, reliable companies. If you’re an income investor or looking for the best stocks for dividend-based passive revenue, this guide is for you.

Dividend Stocks

Before exploring the best dividend-paying stocks for passive earnings, it’s important to understand dividends and why they matter. Dividends are regular payments that companies make to their shareholders out of profits. They are usually distributed quarterly and can be an excellent source of recurring revenue.

For income investors, high-yield dividend stocks for regular income are especially attractive. These stocks offer higher dividend returns than others, meaning more income in your pocket without the need to sell shares. However, it’s crucial to find stocks that provide high yields, are financially sound, and have a strong track record of consistent payouts.

What Makes a Dividend Stock “Best”?

Not all dividend stocks are created equal. Some may offer high yields but come with a high risk, while others might provide steady income at a lower rate. When searching for the best dividend-paying stocks for passive earnings, you need to consider several factors, such as:

- Dividend Yield: The percentage return you’ll earn annually based on the stock price. Generally, anything above 3% is considered a good yield, but higher is often better.

- Dividend Growth: Companies that regularly increase dividend payments show financial health and management confidence.

- Payout Ratio: This measures the percentage of a company’s earnings paid out as dividends. A payout ratio between 40% and 60% is generally considered sustainable.

- Company Stability: It’s important to look for companies with strong financials, consistent earnings, and a history of stable or growing dividend payments.

Now, let’s dive into some of the top dividend stocks that income investors should consider for a steady income.

Johnson & Johnson (JNJ)

Johnson & Johnson is a pharmaceutical and consumer health giant that has been paying dividends consistently for over 50 years. Due to its long track record of dividend growth and stability, it’s a favorite among income investors.

- Dividend Yield: Approximately 2.8%

- Payout Ratio: Around 50%

- Why It’s Ideal: With a history of increasing dividends annually, J&J offers the perfect blend of security and passive income. It’s one of the best stocks for dividend-based passive revenue because of its diverse business model and strong financials.

Procter & Gamble (PG)

Procter & Gamble is another giant in the consumer goods industry. Known for its portfolio of trusted brands, including Tide, Gillette, and Pampers, PG has a strong history of consistent dividend payments.

- Dividend Yield: Around 2.5%

- Payout Ratio: Approximately 60%

- Why It’s Ideal: The company has increased dividends for over 60 years. Its essential products provide stable demand, making it a solid choice for those looking for the best dividend-paying stocks for passive earnings.

-

Coca-Cola (KO)

Coca-Cola is a classic example of a high-yield dividend stock for regular income. The beverage giant has been paying dividends for over a century and is a favorite for passive income investors.

- Dividend Yield: Roughly 3%

- Payout Ratio: Around 75%

- Why It’s Ideal: With a globally recognized brand and stable cash flow, Coca-Cola is among the top dividend stocks for steady income. The company’s robust dividend history makes it a great option for long-term passive revenue generation.

Realty Income (O)

Realty Income is a real estate investment trust (REIT) known for its monthly dividend payments. It focuses on acquiring and managing retail properties, providing a reliable source of income for its investors.

- Dividend Yield: Approximately 4.5%

- Payout Ratio: About 80% (typical for REITs)

- Why It’s Ideal: Often referred to as “The Monthly Dividend Company,” Realty Income is ideal for income investors seeking regular, predictable cash flow. Its high dividend yield stands out among high-yield dividend stocks for regular income.

AT&T (T)

AT&T is a telecommunications giant that offers one of the highest dividend yields among large-cap stocks. Despite concerns over the company’s debt levels, AT&T remains a popular choice for those looking for the best dividend-paying stocks for passive earnings.

- Dividend Yield: Around 6%

- Payout Ratio: Approximately 60%

- Why It’s Ideal: AT&T’s strong market position in telecommunications ensures a steady revenue stream, supporting its generous dividend payments. The high yield is attractive for income-focused investors, though some risk comes from the company’s debt.

Apple (AAPL)

Apple might not have the highest yield, but its combination of dividend growth and share price appreciation makes it a solid choice for income investors.

- Dividend Yield: About 0.5%

- Payout Ratio: 15%

- Why It’s Ideal: Although Apple’s yield is relatively low, its ability to generate massive free cash flow and its track record of increasing dividends make it one of the best dividend-paying stocks for passive earnings. Plus, its stock price has seen significant growth, adding to the total return for investors.

ExxonMobil (XOM)

ExxonMobil, one of the world’s largest energy companies, has been a reliable dividend payer even during turbulent oil market times.

- Dividend Yield: Approximately 5.5%

- Payout Ratio: Around 70%

- Why It’s Ideal: Despite the volatility in the energy sector, ExxonMobil has maintained its dividend payments. Its strong cash flow and commitment to returning value to shareholders make it one of the top dividend stocks for steady income, especially for investors seeking exposure to the energy sector.

Verizon Communications (VZ)

Verizon, another major telecommunications player, offers a high dividend yield, making it a favorite among income investors.

- Dividend Yield: About 7%

- Payout Ratio: 50%

- Why It’s Ideal: Verizon’s reliable dividend payments and strong cash flow from its telecommunications business make it a strong choice for those seeking high-yield dividend stocks for regular income.

PepsiCo (PEP)

Like Coca-Cola, PepsiCo is a consumer staple company that has paid dividends for decades. Its diverse product lineup and global reach make it a reliable income generator.

- Dividend Yield: Approximately 2.7%

- Payout Ratio: 60%

- Why It’s Ideal: PepsiCo’s consistent dividend growth and strong market position make it one of the best stocks for dividend-based passive revenue. Its ability to thrive in both good and bad economic times ensures steady payouts to investors.

McDonald’s (MCD)

McDonald’s is more than just a fast-food company; it’s a global brand with a strong dividend-paying history.

- Dividend Yield: About 2.3%

- Payout Ratio: 65%

- Why It’s Ideal: The fast-food giant’s ability to generate steady cash flow makes it a top choice for income investors. McDonald’s has increased its dividend for over 40 years, making it one of the best dividend-paying stocks for passive earnings.

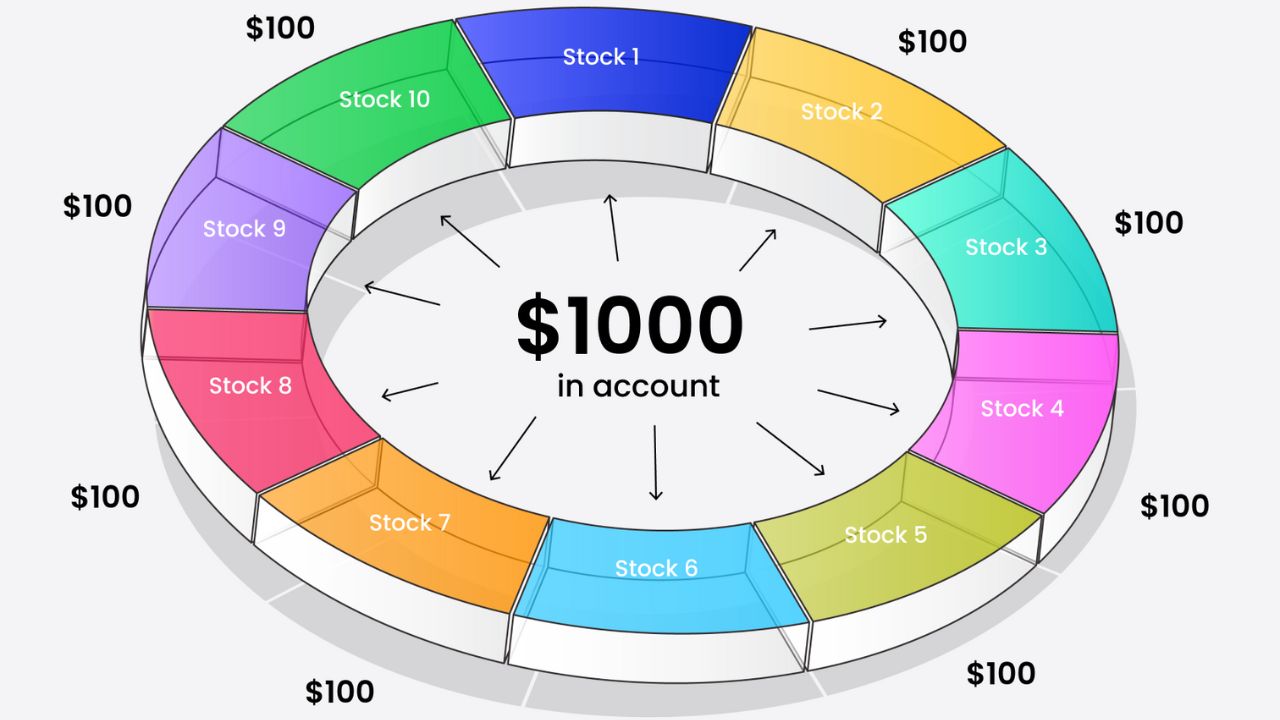

Diversifying Your Dividend Portfolio

While each of the stocks mentioned above is a great option for passive income, diversification is key. You reduce the risk associated with any single company or industry by spreading your investments across multiple sectors—such as consumer goods, telecommunications, and energy. This strategy ensures you’ll continue receiving dividends even if one sector experiences a downturn.

Conclusion

Finding the best dividend-paying stocks for passive earnings requires a careful balance of yield, growth potential, and financial stability. By focusing on top companies like Johnson & Johnson, Procter & Gamble, and Realty Income, you can build a portfolio that provides reliable, steady income for years. Whether you’re seeking high-yield dividend stocks for regular income or the best stocks for dividend-based passive revenue, these companies offer a strong foundation for your financial future.

Investing in dividend stocks can be a powerful way to achieve passive income and long-term financial freedom. By choosing wisely and focusing on quality, you can enjoy consistent returns with minimal effort.

FAQ

Are dividend stocks good for passive income?

Yes, dividend stocks are excellent for passive income. They provide regular payouts without selling shares. Choosing companies with stable dividends and consistent growth can create a reliable income stream, ideal for long-term wealth-building and financial independence.

What is the most profitable dividend stock?

The most profitable dividend stock depends on your investment goals. Historically, stocks like Johnson & Johnson, Coca-Cola, and Procter & Gamble have provided consistent returns and growing dividends, making them profitable for long-term passive income investors seeking stability.

What are the best dividend stocks to buy and hold forever?

The best dividend stocks to buy and hold forever include companies with strong track records of dividend growth, such as Procter & Gamble, Johnson & Johnson, and Realty Income. These companies have proven resilient through economic cycles, making them reliable for long-term passive income.

Which fund has the highest income from dividends?

Funds like Vanguard High Dividend Yield ETF (VYM) or Schwab U.S. Dividend Equity ETF (SCHD) often deliver high income from dividends. They focus on dividend-paying stocks with strong yields, making them ideal for investors seeking consistent, long-term dividend income from diverse portfolios.

How much dividend to make $1000 a month?

To make $1,000 a month in dividends, you’d need a portfolio yielding around 4% annually. This requires an investment of approximately $300,000. Exact amounts vary based on the dividend yield of the stocks or funds you choose, with higher yields requiring less capital.