In the world of finance, few relationships hold as much importance as that between interest rates and bond yields. Understanding this connection is essential for anyone interested in investing, especially in fixed-income securities.

This article explores how interest rates affect bond yields and covers various facets of this interaction, including bond returns, market interest rates, and the specific terms investors encounter in fixed-income investments.

By the end, you’ll have a clear grasp of how bond yields and interest levels work together and how you can make informed investment choices.

Problem: Navigating Bond Yields and Interest Rates

Investors often face confusion when trying to understand the relationship between bond yields and interest rates. Many don’t realize how changes in interest rates directly impact bond earnings and their market value. When rates fluctuate, they set off a chain reaction that affects debt yields, bond returns, and ultimately the investment’s profitability. Without understanding this relationship, investors may make poor decisions, misread market signals, and miss growth opportunities.

Agitation: Why Ignoring Interest Rates Could Hurt Your Investments

Ignoring the impact of interest rates on bond yields could lead to financial loss, especially during periods of rate fluctuation. When interest rates rise, bond values typically drop, meaning investors could lose out if they aren’t prepared for this shift. On the other hand, when interest rates decline, bond prices often increase. Investors who stay unaware of these dynamics might miss out on profit opportunities and also suffer losses from market missteps. The connection between bond yields and interest rates isn’t just a theoretical concept; it’s a fundamental part of debt instrument returns and interest levels that have real implications for wealth building.

Solution: Understanding the Key Dynamics of Bond Yields and Interest Rates

To make the best financial decisions, it’s essential to break down how interest rate shifts affect bond yields, what these terms mean, and how each component contributes to an investor’s returns.

1. How Interest Rates Influence Bond Yields

Interest rates and bond yields have a deeply interconnected relationship. When we talk about bond yields, we’re essentially discussing the return an investor gets from holding a bond until maturity. This “bond rate of return” is influenced heavily by interest rates set by central banks and other factors.

When interest rates rise, newly issued bonds come with higher coupon rates to align with the market. This makes existing bonds with lower coupon rates less attractive, lowering their market value. Conversely, when interest rates drop, existing bonds with higher coupon rates become more attractive, driving up their value.

Example in Action: Debt Yields and Market Interest Rates

Consider a scenario where market interest rates increase from 2% to 4%. An investor holding a bond with a 2% coupon rate suddenly finds their bond less valuable since new bonds now offer 4%. To sell their bond on the secondary market, they would likely have to offer it at a discount. This is a practical illustration of how debt yields and market interest rates interact.

2. Bond Earnings and Rate of Interest: A Practical Example

The “bond earnings” refers to the income generated by a bond, typically through periodic interest payments known as coupon payments. The rate of interest, or yield, is the return on investment based on the bond’s current price in the market.

Let’s say an investor buys a $1,000 bond with a fixed coupon payment of $50 annually, making the bond’s coupon rate 5%. If interest rates rise to 6%, new bonds will offer $60 annually for the same $1,000 investment. Therefore, the value of the original 5% bond will decrease if the investor tries to sell it, as new investors can receive a better return elsewhere. This is why bond earnings and the rate of interest are tightly linked.

3. Fixed-Income Yields and Lending Rates

Fixed-income yields and lending rates also share an essential connection. Bonds are part of the broader fixed-income category, which includes other debt securities like government bonds, corporate bonds, and municipal bonds. Lending rates, which can be influenced by the central bank, determine the baseline for these yields. As the cost of borrowing increases, so does the expected return on fixed-income securities.

In recent years, central banks worldwide have used interest rate policies to influence economic growth. For instance, the Federal Reserve in the United States cut interest rates to near-zero levels during the COVID-19 pandemic to stimulate lending and spending. This impacted fixed-income yields, lowering returns on bonds and other fixed-income instruments but making borrowing cheaper, thereby stimulating the economy.

4. Monetary Rates’ Effect on Bond Yields and Securities Yield

The term “monetary rates” often refers to rates set by a country’s central bank, which impacts the entire financial ecosystem, including bond yields. When the central bank raises interest rates, it signals a tightening of monetary policy, which generally results in higher yields across fixed-income securities.

Case Study: The Fed’s Rate Hike Cycle (2015-2018)

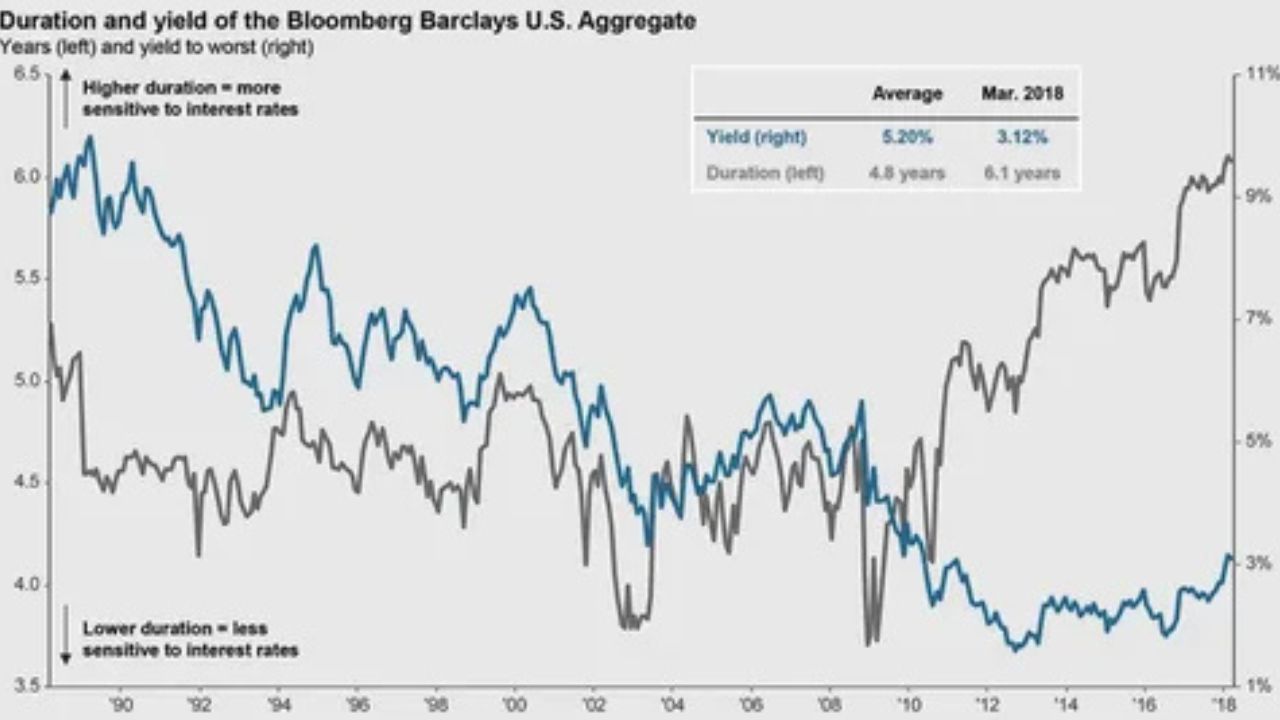

From 2015 to 2018, the Federal Reserve gradually increased interest rates, which led to an increase in bond yields. For instance, U.S. Treasury yields rose from around 2% to nearly 3% during this period. This had broad implications for debt yields and market interest rates, causing fixed-income securities to adjust accordingly. Investors with existing bonds saw the market value of their securities decrease, while those who purchased new bonds benefited from higher yields.

5. Debt Instrument Returns and Interest Levels: Managing Investment Risk

“Debt instrument returns” refer to the income generated from any debt-based security, such as bonds. Understanding how interest levels affect these returns is crucial for managing risk, especially during volatile economic times.

When interest levels fluctuate, the returns on these instruments adjust accordingly. Rising interest rates lead to lower market prices for existing bonds, making them less attractive if they carry a lower coupon. Investors must weigh these factors when purchasing or selling bonds. Monitoring interest rates helps investors strategize effectively, allowing them to choose bonds that align with their risk tolerance and financial goals.

6. The Role of Financial Interest Rates in Bond Investments

Financial interest rates act as a benchmark for setting bond yields. Banks, corporations, and governments issue bonds with interest rates that align with current financial interest rates. If the central bank raises rates, all related debt instruments adjust to maintain market alignment.

In the Eurozone, for example, the European Central Bank (ECB) raised interest rates in response to inflationary pressures in recent years. This shift resulted in higher bond yields, which made bonds a more attractive option for conservative investors. However, it also led to decreased prices for existing bonds issued at lower rates. Investors who understood this relationship could adjust their portfolios accordingly.

7. Securities Yield and Interest Charges: A Balancing Act

“Securities yield” refers to the overall returns from various types of debt securities, while “interest charges” refer to the cost of borrowing. When interest charges rise, the yield on securities like bonds typically increases to compensate investors for the higher borrowing environment.

Historical Insight: 2008 Financial Crisis

During the 2008 financial crisis, central banks lowered interest rates to near zero to stimulate economic growth. As a result, securities yields across bonds and other fixed-income assets dropped significantly. Investors who were aware of this dynamic were able to adapt their strategies accordingly, opting for alternative investments until rates normalized.

8. Strategies for Maximizing Bond Rate of Return

Given the close relationship between interest rates and bond yields, investors can apply various strategies to maximize their returns:

- Laddering Bonds: By purchasing bonds with different maturities, investors can spread risk and adjust to rising or falling interest rates without facing large price changes in their portfolios.

- Staying Informed on Central Bank Policies: Keeping track of announcements from central banks like the Federal Reserve or the ECB can help investors anticipate changes in bond yields and interest levels.

- Choosing Between Short and Long-Term Bonds: Short-term bonds are less sensitive to interest rate changes, making them a good choice during uncertain times. Long-term bonds, however, can offer higher yields in stable-rate environments.

Conclusion: Taking Control of Your Bond Investments

The relationship between interest rates and bond yields is vital for anyone involved in bond markets. By understanding the dynamics of bond returns, market interest rates, and the rate of interest, investors can make informed decisions. Awareness of factors like debt yields, securities yield, and interest charges enables a strategic approach to investing, ensuring that portfolio performance aligns with financial goals.

Investors who grasp these concepts can take advantage of the opportunities created by changes in interest rates, rather than falling victim to them. Whether you’re a novice investor or a seasoned pro, learning about bond yields and monetary rates is essential for successful investing. Stay informed, and monitor interest rate trends, and you’ll be well-positioned to achieve steady returns on your investments.