Choosing the right Health Insurance Coverage Options can feel overwhelming, especially with so many plans, terms, and benefits to compare. From employer-sponsored plans to government programs and private policies, each option comes with unique advantages and limitations. The key to making the right decision is understanding the definitions and differences between them.

Where healthcare expenses are constantly rising, having the right health insurance is no longer optional; it’s essential. A single hospital visit without insurance could cost thousands of dollars, and ongoing care for chronic conditions could drain savings within months. Beyond the financial side, health insurance also ensures peace of mind. Knowing that your health needs are covered allows you to focus on recovery and wellness rather than bills and paperwork.

Not all health insurance is created equal. From employer-sponsored plans to government programs, from HMOs to PPOs, the variety can be overwhelming. That’s why understanding health insurance by definition, breaking down the terms, comparing the options, and weighing the pros and cons, is the first step to making an informed decision.

What is Health Insurance?

Health Insurance Coverage Options. At its core, health insurance is an agreement between you and an insurance provider. You pay a set amount, usually monthly (called a premium), and in return, the insurer helps cover the cost of your healthcare. This includes doctor visits, hospital stays, prescription medications, lab tests, preventive screenings, and even mental health services, depending on your plan.

Think of it like a partnership: you handle your share of the costs, and the insurer steps in to cover the larger, often unexpected, expenses. For example, you might pay $30 for a doctor visit (a copay), while the insurer covers the remaining $150. If you undergo surgery that costs $20,000, your insurance might handle 80–90% of it, leaving you with a much smaller, manageable bill.

One important aspect of health insurance is risk pooling. By pooling together premiums from many people, insurance companies create a fund that can be used to pay for the medical needs of those who fall sick or require care. This system ensures that healthcare costs are distributed fairly across a group rather than burdening one individual.

Why Health Insurance Matters in Today’s World

Health Insurance Coverage Options, Healthcare costs in the U.S. and many other countries are skyrocketing. Without insurance, a trip to the emergency room could cost more than your monthly rent, and specialized treatments like chemotherapy or surgeries could easily exceed six figures. For many families, such expenses are devastating.

Health insurance isn’t just about cost coverage; it’s also about access. People with insurance are more likely to visit doctors regularly, get preventive screenings, and receive timely care. This leads to better long-term health outcomes. On the other hand, people without insurance often delay care because of the high costs, which can make health problems worse over time.

Another critical factor is mental well-being. When you have insurance, you don’t live with the constant fear of financial ruin due to an accident or illness. You can focus on staying healthy rather than worrying about what would happen if you needed care tomorrow.

Many employers provide insurance as part of their benefits package, making it a crucial factor in employment decisions. People often weigh job offers based not only on salary but also on the quality of the health insurance provided.

Terminologies in Health Insurance

Health insurance can feel like learning a new language. Terms like premiums, deductibles, and copayments might sound intimidating, but once you break them down, they’re quite simple. Let’s go through the essential definitions that form the backbone of any health insurance plan.

1. Premiums

A premium is the amount you pay every month to keep your insurance active. Think of it like a subscription fee for Netflix, but instead of movies, it’s healthcare coverage. Even if you don’t use any healthcare services in a given month, you still have to pay the premium to stay insured.

2. Deductibles

A deductible is the amount you must pay out-of-pocket before your insurance starts covering costs. For example, if your deductible is $2,000, you’ll pay that much for medical expenses before your insurer starts sharing the costs. Higher deductible plans usually come with lower premiums, while lower deductible plans often mean higher premiums.

3. Copayments and Coinsurance

A copayment (copay) is a flat fee you pay for a healthcare service. For instance, you might pay $25 every time you see your primary doctor. Coinsurance, on the other hand, is a percentage of the cost you share with the insurer. For example, if your coinsurance is 20%, you’d pay 20% of the bill, and the insurer pays the remaining 80%.

4. Out-of-Pocket Maximums

The out-of-pocket maximum is the ceiling on how much you’ll spend in a year for covered healthcare services. Once you hit this limit, your insurance pays 100% of covered costs for the rest of the year. This feature ensures that even in the worst-case scenario, say, multiple surgeries or a chronic condition, you won’t go bankrupt.

These terms may seem like small details, but they dramatically affect how much you’ll actually spend on healthcare. Choosing a plan without understanding these can lead to unpleasant surprises down the road.

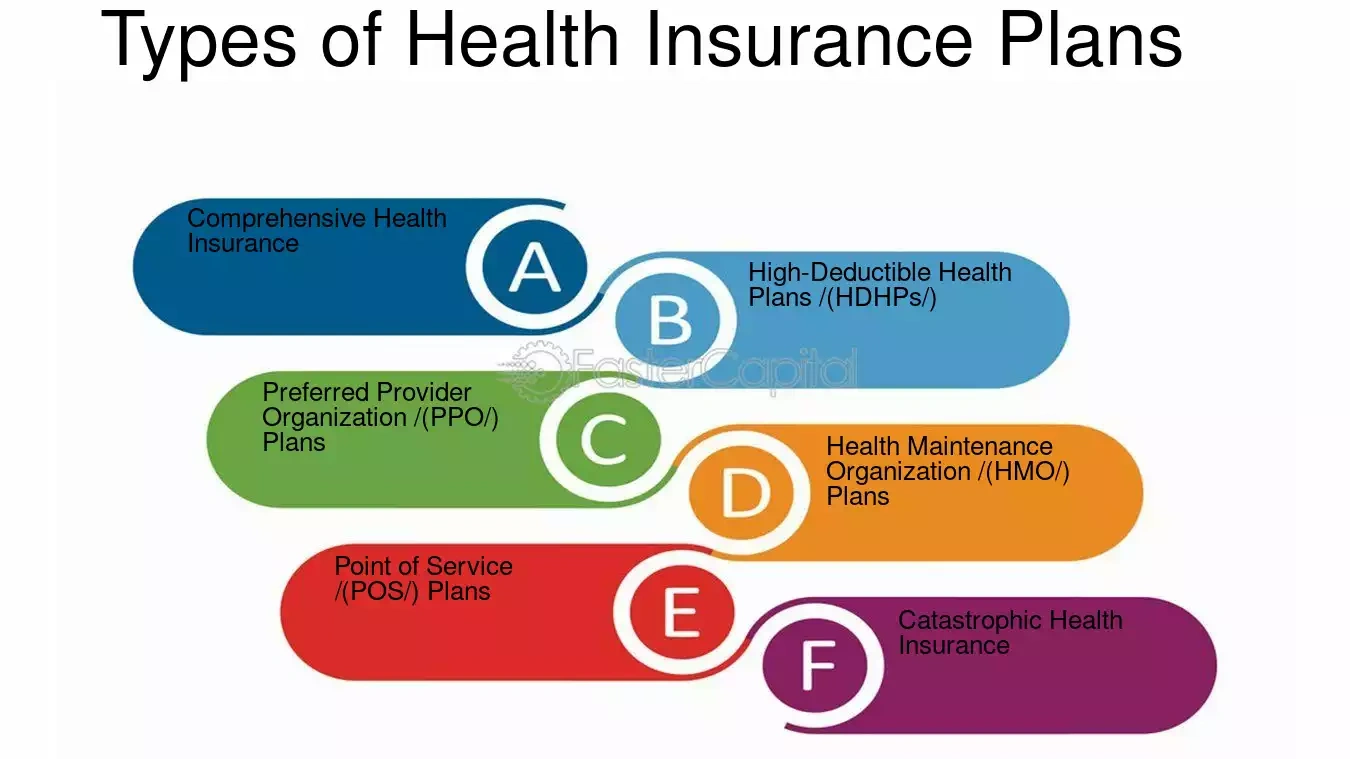

Types of Health Insurance Coverage Options

Health insurance isn’t one-size-fits-all. There are different categories of coverage tailored to meet different needs. Let’s break them down by definition:

a) Employer-Sponsored Health Insurance

This is the most common type of health insurance in the U.S. Employers often cover a significant portion of the premiums, making it more affordable for employees. Plans vary widely but usually offer comprehensive coverage, including preventive care, hospitalization, and prescription drugs. The downside? You’re limited to what your employer offers, which may not always be the best fit for your needs.

b) Individual and Family Plans

If you don’t get insurance through an employer, you can buy your own plan through the healthcare marketplace or directly from an insurer. These plans can be customized to your needs, but often come with higher premiums. The upside is flexibility; you choose the plan that works for your lifestyle and family.

c) Government Programs

Programs like Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP) provide coverage for specific groups. Medicare serves seniors and people with disabilities, Medicaid supports low-income families, and CHIP helps children who don’t qualify for Medicaid but can’t afford private coverage. These programs ensure that vulnerable populations aren’t left without care.

d) Short-Term Health Insurance

These plans are temporary solutions, often lasting from a few months up to a year. They’re designed to fill gaps in coverage, such as when you’re between jobs. While they’re affordable, they usually offer limited benefits and may not cover essential health needs.

Comparing Private vs. Public Health Insurance

When it comes to health insurance, you’ll often hear about private and public options. Let’s compare them by definition and practical benefits.

Benefits of Private Health Insurance

Private health insurance, often purchased through employers or individually, typically offers more choices in terms of providers, coverage options, and add-ons like dental or vision insurance. It also tends to provide faster access to specialists and elective treatments.

However, private insurance can be costly, especially if your employer doesn’t subsidize it. Premiums and deductibles are often higher, and out-of-pocket costs can add up quickly.

Advantages of Public Health Insurance

Public health insurance programs like Medicare and Medicaid aim to make healthcare accessible and affordable for specific groups. The primary advantage is affordability; many enrollees pay little to nothing for coverage. Additionally, public programs are often more standardized, so there’s less confusion when choosing coverage.

Key Differences Between the Two

The main distinction lies in eligibility and cost. Private insurance is widely available but comes with higher costs, while public programs are restricted to certain groups but are generally more affordable. Another key difference is flexibility: private plans usually offer more provider choices, while public insurance often has stricter network limitations.

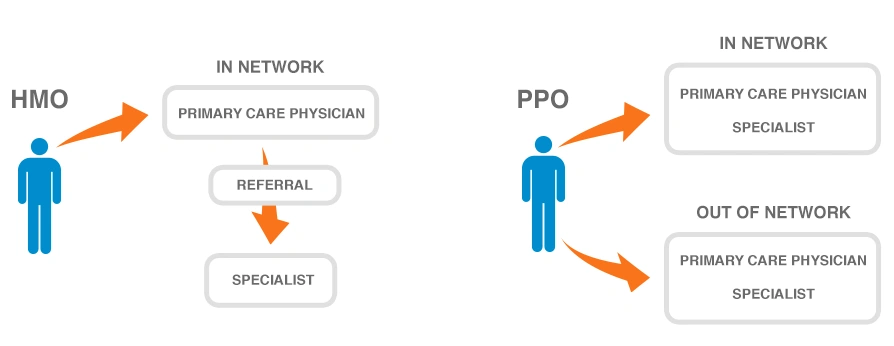

Health Maintenance Organizations (HMOs) vs. Preferred Provider Organizations (PPOs)

When choosing health insurance, two of the most common terms you’ll encounter are HMO and PPO. These refer to different types of provider networks and coverage rules, and understanding the differences can save you both money and frustration. Let’s break them down by definition.

Definition of HMOs

A Health Maintenance Organization (HMO) is a type of insurance plan that requires members to choose a primary care physician (PCP). This doctor acts as your healthcare gatekeeper, meaning you must get referrals from your PCP to see specialists.

The main characteristic of an HMO is its restricted provider network. You’re generally only covered if you use doctors, hospitals, and specialists within the network. If you go out-of-network, you’ll likely have to pay the full cost yourself (except in emergencies).

Advantages of HMOs:

-

Lower monthly premiums compared to PPOs.

-

Lower out-of-pocket costs.

-

Emphasis on preventive care to keep you healthy.

Disadvantages of HMOs:

-

Less flexibility, you can’t just see any doctor without a referral.

-

Out-of-network coverage is almost nonexistent.

-

Longer wait times for specialist appointments due to referral requirements.

Think of an HMO like a “members-only club.” Once you’re in, the services are affordable, but you have to play by the club’s rules.

Definition of PPOs

A Preferred Provider Organization (PPO) is more flexible than an HMO. With a PPO, you don’t need a referral to see a specialist. You can also see doctors outside the network, though it will cost more than staying in-network.

Advantages of PPOs:

-

Greater flexibility in choosing doctors and specialists.

-

No need for referrals.

-

Out-of-network care is covered (at a higher cost).

Disadvantages of PPOs:

-

Higher premiums compared to HMOs.

-

Higher deductibles and coinsurance in many cases.

-

You may end up paying more overall if you don’t use the plan wisely.

Think of a PPO as the “buffet” of health insurance. You pay a higher entry fee, but you have more freedom to choose what you want.

Differences and Which to Choose

When comparing HMOs and PPOs, the choice usually boils down to cost vs. flexibility. If you’re budget-conscious and don’t mind going through a primary doctor for referrals, an HMO might be best. If you value choice and want to avoid the hassle of referrals, a PPO may be worth the higher price tag.

In general:

-

HMO = Lower cost, less freedom

-

PPO = Higher cost, more freedom

Your decision should depend on your healthcare needs, budget, and whether your preferred doctors are in-network.

Exclusive Provider Organization (EPO) and Point of Service (POS) Plans

While HMOs and PPOs are the most popular, there are two other types of plans worth considering: EPOs and POS plans. These fall somewhere in between in terms of cost and flexibility.

What is an EPO Plan?

An Exclusive Provider Organization (EPO) plan is similar to an HMO in that it requires you to stick to a network of doctors and hospitals. The main difference? You don’t need a referral to see a specialist within the network.

Advantages of EPOs:

-

Lower premiums compared to PPOs.

-

No referrals required.

-

Emphasis on using in-network doctors for lower costs.

Disadvantages of EPOs:

-

No out-of-network coverage (except emergencies).

-

Smaller provider networks compared to PPOs.

In short, an EPO gives you a balance where you save money by sticking to the network, but don’t need to go through a gatekeeper for every specialist visit.

What is a POS Plan?

A Point of Service (POS) plan combines elements of both HMOs and PPOs. Like an HMO, you need a primary care physician for referrals. However, like a PPO, you can get care outside the network, though you’ll pay more for it.

Advantages of POS plans:

-

More provider flexibility than HMOs.

-

In-network care is affordable.

-

Coverage for out-of-network care is available (but expensive).

Disadvantages of POS plans:

-

Higher paperwork if you use out-of-network providers.

-

Premiums are higher than HMOs but lower than PPOs.

-

Requires referrals for specialist care.

Think of POS plans as a “middle ground”, not as strict as HMOs, not as flexible as PPOs, but offering a bit of both worlds.

Comparison of EPO vs. POS

-

EPO = No referrals needed, but no out-of-network coverage.

-

POS = Referrals required, but limited out-of-network coverage available.

If you rarely travel and are fine staying in-network, an EPO could save you money. But if you want some flexibility in case your doctor isn’t in-network, a POS may be better.

High-Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs)

In recent years, HDHPs paired with HSAs have gained popularity, especially among younger and healthier people who don’t use healthcare services often. Let’s break them down.

Definition of HDHPs

A High-Deductible Health Plan (HDHP) is exactly what it sounds like: a plan with a higher deductible than traditional plans. In exchange, you pay lower monthly premiums.

For 2025, the IRS defines an HDHP as a plan with:

-

A deductible of at least $1,600 for individuals or $3,200 for families.

-

An out-of-pocket maximum of $8,050 for individuals or $16,100 for families.

These plans are designed to encourage people to take more control of their healthcare spending. They work well if you’re generally healthy and only need occasional doctor visits.

How HSAs Work with HDHPs

An HSA (Health Savings Account) is a tax-advantaged savings account that you can use alongside an HDHP. You put money into the HSA before taxes, it grows tax-free, and you can withdraw it tax-free when used for qualified medical expenses.

Benefits of HSAs:

-

Triple tax advantage (tax-free contributions, growth, and withdrawals).

-

Funds roll over year to year; you never lose unused money.

-

Portability: You keep your HSA even if you change jobs or insurance.

This makes HSAs not just a medical savings tool but also a long-term financial planning strategy. Many people even treat their HSA like a retirement account.

Pros and Cons of HDHPs with HSAs

Pros:

-

Lower premiums mean immediate savings.

-

HSA tax advantages help long-term.

-

Ideal for healthy individuals or those who don’t expect major medical expenses.

Cons:

-

High upfront costs if you need major care before meeting the deductible.

-

Not great for people with chronic conditions.

-

Can lead to delaying necessary care to avoid expenses.

HDHPs with HSAs work best for younger, healthier people or those with enough savings to cover unexpected medical costs.

Consider When Choosing a Health Insurance Plan

With so many options, HMOs, PPOs, EPOs, POS, HDHPs, it’s easy to get overwhelmed. The right plan depends on your unique situation. Here are the main factors to weigh.

Cost Considerations

When choosing insurance, look beyond just the monthly premium. Also consider:

-

Deductibles (how much you’ll pay before coverage kicks in).

-

Copayments and coinsurance.

-

Out-of-pocket maximums.

Sometimes a plan with a low premium ends up being more expensive overall because of higher deductibles and cost-sharing.

Coverage and Benefits

Ask yourself:

-

Does the plan cover prescriptions you take regularly?

-

Are mental health, maternity, or preventive services included?

-

Are dental and vision included, or do you need separate coverage?

Not all plans cover the same benefits, so always check the fine print.

Provider Networks

If you have a preferred doctor or hospital, make sure they’re in-network. Out-of-network costs can be astronomical. For people who travel frequently, a broader provider network might be crucial.

Lifestyle and Family Needs

-

Singles and young adults may prefer HDHPs with HSAs.

-

Families may need comprehensive coverage with pediatric, maternity, and preventive services.

-

Older adults or people with chronic conditions may benefit from lower deductibles and broader coverage.

At the end of the day, choosing health insurance is like picking a phone plan; you want something that fits your usage, lifestyle, and budget without leaving you with gaps in coverage.

International Health Insurance Coverage

Not all health insurance is limited to your home country. For those who travel, study abroad, or relocate, international coverage becomes essential.

Insurance for Expats and Travelers

Expats and frequent travelers often need specialized insurance plans. These plans cover:

-

Emergency care abroad.

-

Hospitalization and doctor visits overseas.

-

Evacuation coverage (flying you to a facility in your home country if needed).

Without this, a medical emergency abroad could bankrupt you—some hospital stays overseas can cost tens of thousands of dollars upfront before treatment begins.

Global Coverage vs. Domestic Plans

Most domestic insurance only covers care in your home country, and even then, networks are limited to certain regions. International health insurance expands that coverage globally, ensuring you’re protected wherever you go.

Some global policies even allow you to receive treatment in another country if the medical care is better or more affordable.

When International Health Insurance is Essential

-

Students studying abroad.

-

Retirees moving to another country.

-

Remote workers or digital nomads.

-

Frequent international travelers.

International health insurance isn’t a luxury; it’s a necessity for those living or working beyond borders.

Comparing Health Insurance for Different Age Groups

Health insurance needs shift drastically depending on where you are in life. What works well for a 25-year-old might not be suitable for a family of four or a retiree. Let’s break it down by age group to understand which coverage options make the most sense.

Coverage for Young Adults

Young adults, often in their 20s and early 30s, are generally healthier and may not require frequent medical care. For this group, affordability and flexibility are usually the top priorities.

Common Options:

-

Parents’ plan (up to age 26 in the U.S.): Many young adults stay on their parents’ insurance until they age out. This is often the most affordable and convenient option.

-

HDHPs with HSAs: Healthy young professionals may opt for high-deductible plans paired with HSAs to save money on premiums while building a tax-free medical savings fund.

-

Marketplace individual plans: For freelancers, entrepreneurs, or those without employer coverage, marketplace plans offer flexible choices.

Why it works: Most young adults don’t need extensive coverage, so a low-cost plan with basic preventive care and emergency coverage is often enough. However, having insurance is still critical, since accidents or sudden illnesses can happen anytime.

Coverage for Families

Families typically need more comprehensive coverage since they’re insuring multiple people with varying health needs. Preventive care, pediatric visits, maternity care, and prescription coverage become top priorities.

Common Options:

-

Employer-sponsored family plans: Many companies offer family coverage at group rates, which is often more affordable than buying individual plans for each member.

-

PPOs or POS plans: Families often prefer these because they provide flexibility when choosing pediatricians and specialists.

-

Supplemental coverage (dental and vision): Essential for kids and adults alike, since most standard health plans don’t include these services.

Why it works: Family plans prioritize broad coverage and provider choice. With children’s frequent doctor visits and possible emergencies, having a plan that minimizes out-of-pocket expenses is key.

Coverage for Seniors

For seniors, health insurance shifts toward managing chronic conditions, prescription drugs, and preventive care. Most seniors in the U.S. qualify for Medicare once they turn 65.

Common Options:

-

Medicare: Covers hospital care (Part A), outpatient care (Part B), and can be expanded with prescription drug coverage (Part D).

-

Medicare Advantage (Part C): Combines Parts A, B, and sometimes D into one plan, often with added benefits like dental or vision.

-

Medigap (Supplemental Insurance): Helps cover costs that Medicare doesn’t, such as deductibles and copayments.

Why it works: Seniors tend to have higher healthcare needs, so comprehensive coverage is essential. Medicare and supplemental plans ensure they aren’t burdened with overwhelming medical expenses in retirement.

Supplemental Insurance Options

Standard health insurance doesn’t cover everything. Supplemental insurance options help fill the gaps and provide additional protection.

Dental and Vision Insurance

Most health insurance plans exclude routine dental and vision care. That’s where separate policies or employer add-ons come in.

-

Dental insurance typically covers preventive cleanings, X-rays, and a portion of major dental work like fillings, crowns, or braces.

-

Vision insurance covers annual eye exams, glasses, and contact lenses.

These are especially valuable for families with kids (who often need braces or glasses) and for older adults.

Critical Illness and Accident Insurance

Critical illness insurance provides a lump sum payout if you’re diagnosed with a serious condition like cancer, stroke, or heart disease. Accident insurance helps cover costs related to unexpected injuries.

These plans are designed to supplement your primary coverage, giving you extra cash to cover non-medical expenses like mortgage payments, childcare, or travel costs while you recover.

Long-Term Care Insurance

This covers services like nursing homes, assisted living, or in-home care, things that traditional health insurance and Medicare don’t usually pay for. With life expectancy increasing, long-term care insurance is becoming more important for middle-aged and older adults planning.

The Role of Telemedicine in Health Insurance

Telemedicine has experienced a surge in popularity, particularly since the COVID-19 pandemic. Many insurance plans now include some form of telehealth coverage, which has transformed how we access care.

How Telemedicine Coverage Works

Telemedicine allows you to consult with doctors via video calls, phone calls, or even secure messaging apps. Insurers often treat these visits like regular office visits, applying copays or coinsurance. Some plans even offer free or discounted telehealth visits for common issues, such as colds, skin conditions, or mental health therapy.

Advantages of Telemedicine-Enabled Plans

-

Convenience: No need to drive to a clinic or sit in a waiting room.

-

Lower costs: Telehealth visits are usually cheaper than in-person visits.

-

Accessibility: Especially valuable for rural or underserved areas.

-

Continuity of care: Great for ongoing conditions that need regular check-ins.

Limitations of Telehealth Services

-

Not suitable for emergencies: You can’t get surgery or physical exams via video.

-

Technology barriers: Older adults or those without reliable internet may struggle.

-

Limited scope: Some conditions still require in-person diagnostics.

Despite these drawbacks, telemedicine is here to stay and will likely become even more integrated into health insurance in the future.

Conclusion

Health Insurance Coverage Options: Health insurance is not one-size-fits-all. Whether you’re a young adult, a parent, or a retiree, there are coverage options designed to meet your needs. From HMOs and PPOs to Medicare and international health plans, the key is understanding the definitions, weighing the pros and cons, and considering your lifestyle and financial situation.

By comparing plans carefully and avoiding common mistakes, you can protect both your health and your wallet. Remember: the best health insurance plan isn’t necessarily the cheapest or the most comprehensive, it’s the one that fits you and your family’s unique needs.

FAQ

What’s the Difference Between A Deductible and an Out-of-Pocket Maximum?

Health Insurance Coverage Options: A deductible is what you pay before insurance starts covering costs. An out-of-pocket maximum is the most you’ll pay in a year for covered services—after that, insurance covers everything 100%.

Can I Have Both Private and Public Health Insurance at the Same Time?

Yes, many people combine Medicare with private supplemental insurance for broader coverage.

Is Short-Term Health Insurance A Good Idea?

Health Insurance Coverage Options. It can be useful for temporary gaps (like between jobs), but it usually lacks comprehensive benefits.

How Do I Know if My Doctor is Covered Under My Plan?

Health Insurance Coverage Options: Check your insurance provider’s online directory or call customer service before enrolling.

What’s the Best Health Insurance for Self-Employed Individuals?

Health Insurance Coverage Options, Marketplace individual plans or HDHPs with HSAs are popular choices. Some freelancers also join professional associations that offer group coverage.