Choosing a health insurance plan starts with understanding your needs. Consider how often you visit doctors, take medications, or require specialist care. Compare monthly premiums, deductibles, co-pays, and out-of-pocket maximums. Check if your preferred doctors and hospitals are in-network. Review plan types—such as HMO, PPO, EPO, or POS—and choose one that best fits your flexibility needs. Look at what’s covered, especially for mental health, maternity, or chronic conditions. Consider if you qualify for subsidies through the Marketplace. Don’t just go for the cheapest plan—balance costs with coverage and provider access to get the best value. Always read the plan’s summary carefully.

To choose a health insurance plan, first assess your healthcare needs and consider your budget. Then, compare different plans based on premiums, deductibles, copays, coinsurance, and out-of-pocket maximums. Check if your preferred providers are in-network and review prescription drug coverage. Finally, consider the type of plan (HMO, PPO, etc.) and whether you need a plan that allows for HSAs or FSAs.

What Health Insurance Covers

At its core, health insurance helps cover your medical expenses. This includes everything from routine checkups to major surgeries, depending on the plan. Thanks to the Affordable Care Act (ACA), all Marketplace plans and most employer-sponsored plans must include 10 essential health benefits, which cover:

- Emergency services

- Hospitalization

- Doctor visits and outpatient care

- Maternity and newborn care

- Mental health and substance use treatment

- Prescription drugs

- Preventive and wellness services

- Pediatric services (including dental and vision for kids)

- Rehabilitative and habilitative services

- Lab tests

Some plans go beyond these basics, offering additional benefits like dental and vision coverage, gym memberships, telehealth services, and wellness rewards.

Understanding what a plan covers is the first step to making sure your health needs will be met—without surprise bills.

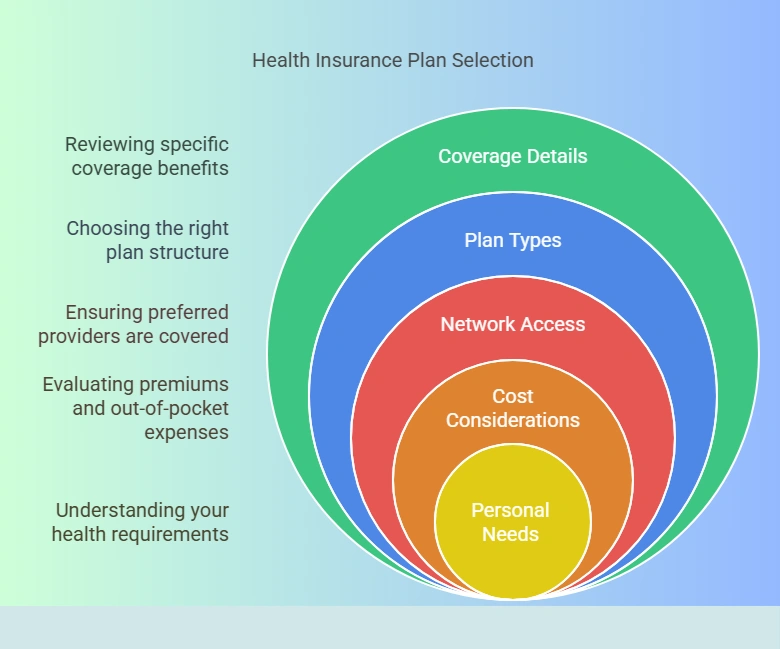

Health Insurance Plan Selection

Choosing the right health insurance plan isn’t just about picking the cheapest option—it’s about finding a balance between cost, coverage, access, and your personal needs. If you want peace of mind and the right protection, here’s a breakdown of the key factors to focus on during your selection process.

Coverage Details

Start by checking what medical services the plan covers. All ACA-compliant plans include 10 essential health benefits such as preventive care, emergency services, mental health treatment, maternity care, and prescription drugs. But it’s still important to look at the plan’s Summary of Benefits to know the details, like how many physical therapy visits are covered or whether brand-name drugs are included.

If you have ongoing health issues or specific needs, such as mental health therapy or regular medications, make sure those services are fully covered under the plan. Some plans may limit the number of visits or require referrals.

Plan Types

Health insurance plans come in different structures. Understanding them helps you avoid surprise bills and access care more easily.

- HMO (Health Maintenance Organization): You must choose in-network doctors and get referrals to see specialists. It’s cost-effective but limited in flexibility.

- PPO (Preferred Provider Organization): Offers freedom to see any doctor without a referral, including out-of-network (at a higher cost).

- EPO (Exclusive Provider Organization): Similar to PPO, but no coverage outside the network.

- POS (Point of Service): Requires referrals but allows limited out-of-network care.

Choose based on how much flexibility you want versus how much you’re willing to spend.

Network Access

A health insurance plan is only as useful as the doctors and hospitals it includes. Always check the network of providers. If you have a preferred doctor or clinic, confirm they are in-network to avoid higher fees or denied claims.

Plans with smaller networks (common in HMO or EPO plans) may not include specialists or top-rated hospitals in your area. For people in rural locations, wide network access is even more critical.

Cost Considerations

Many people look at the monthly premium alone, but that’s just part of the full cost. Also consider:

- Deductible: The amount you pay before the plan begins covering services.

- Copay/Coinsurance: Your share of each visit or treatment.

- Out-of-pocket maximum: Once you hit this, the plan pays 100% of costs.

If you expect frequent medical care, it may be worth paying a higher premium for a plan with lower deductibles and better cost sharing.

Personal Needs

Your current health, age, family size, and lifestyle all impact what plan is right for you. For example:

- A young, healthy adult might prefer a high-deductible plan with a low premium.

- A family with children may need better pediatric coverage.

- Someone with a chronic condition might value low out-of-pocket limits and access to top specialists.

The best plan is the one that fits your real life, not just your budget.

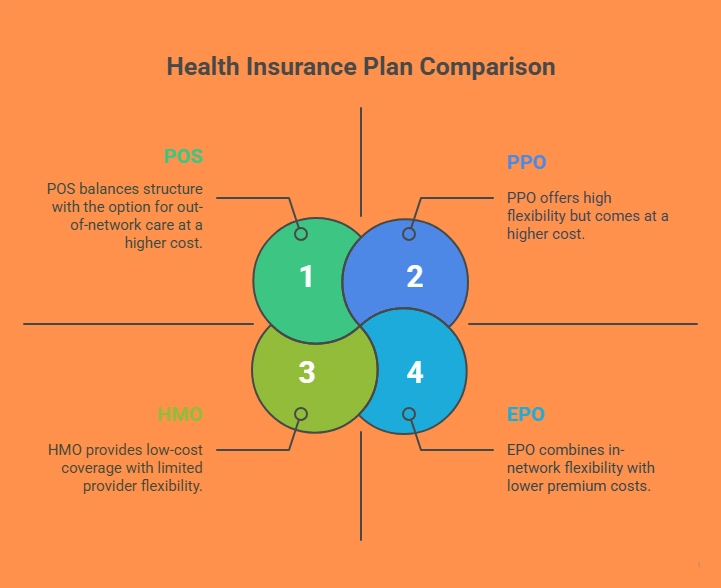

The Different Types of Health Insurance Plans

Health insurance isn’t one-size-fits-all. Plans come in different formats, and each one affects how you access care and how much you’ll pay. Here are the four main types:

1. HMO (Health Maintenance Organization)

With HMOs, you’re required to choose a primary care provider (PCP). This doctor manages your care and gives referrals to specialists. You can only see in-network doctors unless it’s an emergency.

Best for: People who want low monthly premiums and don’t mind sticking to a local provider network.

2. PPO (Preferred Provider Organization)

PPOs offer more flexibility. You don’t need a referral to see specialists, and you can visit out-of-network providers, although it costs more.

Best for: People who want provider flexibility and are okay with paying a bit more.

3. EPO (Exclusive Provider Organization)

Like a PPO, you don’t need a referral. But unlike PPOs, you must stay in-network for coverage—unless it’s an emergency.

Best for: People who want a lower premium and are comfortable using in-network providers only.

4. POS (Point of Service)

This is a hybrid. You choose a PCP and need referrals, but can still see out-of-network providers at higher costs.

Best for: People who want a balance between structure and freedom.

Check the Provider Network

The provider network is a list of doctors, specialists, hospitals, and clinics that work with the insurance plan. Always check the network before enrolling, especially if you have a preferred doctor or hospital.

Seeing an in-network provider means your insurance company has negotiated lower rates, and you’ll pay less. Going out-of-network can mean higher costs or no coverage at all.

What to check:

- Is your current doctor in-network?

- Are nearby hospitals covered?

- Is your preferred pharmacy included?

Don’t assume. Use the plan’s website or call customer service to confirm.

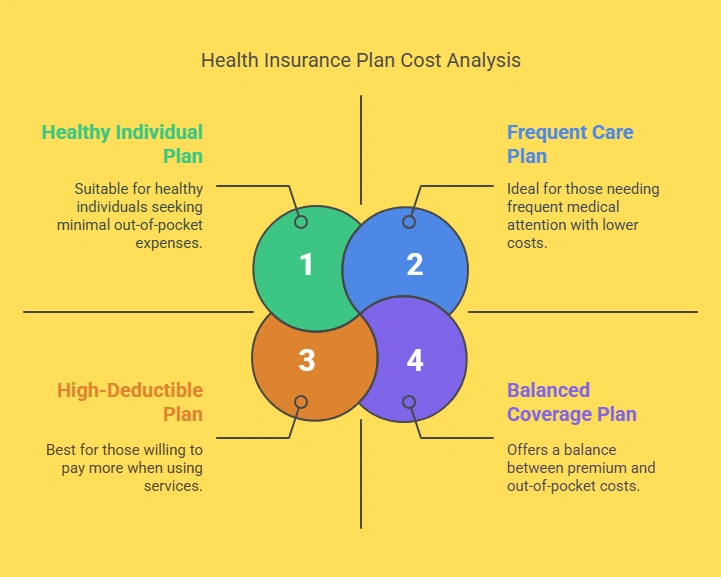

Look at Monthly Premiums vs. Out-of-Pocket Costs

The monthly premium is what you pay just to keep your plan active, even if you don’t use it. But there are other costs to factor in:

- Deductible: How much you pay out-of-pocket each year before the plan starts paying.

- Copayment: A fixed cost for visits or prescriptions (e.g., $25 for a doctor visit).

- Coinsurance: Your share of the cost after the deductible is met (e.g., 20% of hospital bills).

- Out-of-pocket maximum: The maximum you’ll ever pay in a year. Once you reach it, the insurance covers 100% of services.

Low-premium plans often come with high deductibles, meaning you’ll pay more when you use services. On the other hand, higher-premium plans may have lower deductibles and copays, which is great if you need frequent care.

Tip: If you’re generally healthy, a high-deductible plan may save you money. But if you visit doctors often or manage a condition, you may be better off with a lower deductible plan.

Think About Your Medical Needs

Your personal or family medical history plays a big role in choosing the right plan.

Ask yourself:

- Do I see a doctor regularly?

- Do I take daily or monthly prescriptions?

- Am I planning to have a baby or surgery soon?

- Do I need specialist care, like a cardiologist or therapist?

If you rarely see a doctor and want to save on premiums, a Bronze or Silver plan might work. But if you need ongoing care, look for a Gold or Platinum plan with lower out-of-pocket costs—even if the monthly premium is higher.

Also, if you’re covering dependents, consider their needs too—kids may need pediatricians, vaccines, or dental and vision care.

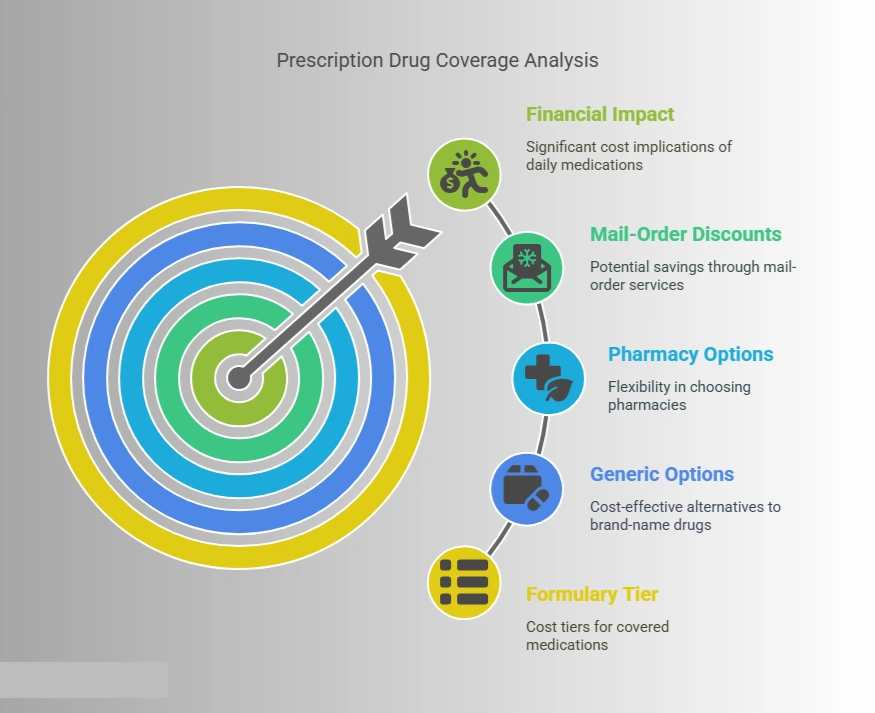

Check for Prescription Drug Coverage

Not all plans cover every medication. Each insurance company has a formulary—a list of covered drugs arranged by cost tiers. Brand-name or specialty drugs usually fall into higher-cost tiers.

Here’s what to look for:

- Are your prescriptions on the formulary?

- What tier are they in?

- Are generic options covered?

- Can you use your preferred pharmacy?

- Does the plan offer mail-order discounts?

If you take daily medications, this part of the plan can have a major financial impact.

Conclusion

Choosing a health insurance plan doesn’t have to be stressful. With a little research and the right questions, you can pick a plan that fits your health needs, your doctor preferences, and your budget.

Here’s a quick checklist before you decide:

- Review what services the plan covers

- Understand the type of plan (HMO, PPO, EPO, POS)

- Confirm that your doctors and hospitals are in-network

- Compare premiums, deductibles, and copays/coinsurance

- Consider your current and future medical needs

- Check the prescription drug list for your medications

Health insurance is about more than just staying legal—it’s about staying protected. The right plan can save you thousands of dollars and give you peace of mind when life throws you a curveball.

FAQ

How to select a health insurance plan?

Choose a Plan in the Health Insurance, Compare plans based on your medical needs, budget, provider network, and drug coverage. Review premiums, deductibles, and out-of-pocket maximums. Choose a plan that balances monthly costs with access to care, and make sure your doctors and medications are included in the coverage network.

How do I find the best insurance plan for me?

Choose a Plan in the Health Insurance, Start by assessing your health needs and budget. Use Healthcare.gov or your employer’s portal to compare plans. Check network access, coverage for prescriptions, and annual costs. The best plan offers the services you need at a price you can afford, with your preferred doctors included.

What are the 4 most common health insurance plans?

Choose a Plan in the Health Insurance, The four most common health insurance plan types are HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), EPO (Exclusive Provider Organization), and POS (Point of Service). Each differs in flexibility, network rules, and costs. Choose based on how much freedom and referral access you want.

How to choose between HMO and PPO?

Choose a Plan in the Health Insurance, choose HMO if you want lower costs and are okay with staying in-network with referrals. Pick a PPO for more freedom to choose doctors and see specialists without referrals. PPOs are more flexible but typically cost more. Your decision should match your health needs and provider preferences.

Which is better, Anthem, PPO, or HMO?

Choose a Plan in the Health Insurance, Anthem offers both PPO and HMO plans. PPO is better for flexibility and out-of-network care, while HMO is more affordable with in-network restrictions. The better option depends on your budget, health needs, and whether your preferred doctors are in the network for each plan.