Life insurance might not be a topic we think about every day, but it’s one of the most powerful tools you can use to protect your loved ones financially. Think of it like a financial safety net that catches your family when you’re no longer around to support them. It ensures that your death doesn’t create a massive financial hole—whether it’s covering daily expenses, paying off debts, or funding your children’s education.

It’s easy to ignore life insurance when everything’s going smoothly. But life is unpredictable. Imagine for a moment what would happen to your family if you weren’t here tomorrow. Who would pay the mortgage? Who would take care of the kids? Would they have to move, sell assets, or struggle just to get by?

That’s where life insurance steps in. It provides a lump sum payout, known as the death benefit, to your beneficiaries—typically your spouse, children, or other dependents. This money is usually tax-free and can be used however they see fit, from paying off bills to simply maintaining their standard of living.

The Basics of Life Insurance

Definition and Purpose

At its core, life insurance is a contract between you and an insurance company. You agree to pay a set amount—called a premium—either monthly or annually. In exchange, the insurer promises to pay a death benefit to your chosen beneficiaries when you die. Simple, right?

But let’s break it down even further. The purpose of life insurance isn’t just about death—it’s about life. Your life. Your family’s future. It’s about ensuring that your dreams for your loved ones don’t die with you. It’s about legacy.

Most people buy life insurance to:

- Replace lost income

- Pay off outstanding debts (mortgage, loans, credit cards)

- Cover funeral and burial costs

- Fund children’s education

- Leave an inheritance

- Cover estate taxes

The beauty of life insurance is its flexibility. It adapts to your personal goals, financial situation, and family needs.

How Life Insurance Works

Life insurance is beautifully straightforward once you get the hang of it. Here’s a quick breakdown:

- You apply for a Policy: You choose the type, amount, and term of coverage.

- You Pay Premiums: This is usually monthly or annually.

- Coverage Begins: After approval, your beneficiaries are protected.

- If You Die: The insurer pays out the agreed-upon amount (death benefit).

- If You Live: Some policies (like whole life) build cash value over time, which you can borrow against.

Let’s say you buy a 20-year term life insurance policy worth $500,000 at age 30. If you die anytime before you turn 50, your beneficiaries get that full amount. If you live past 50, the coverage ends unless you renew or convert it.

What makes life insurance unique is that some policies also serve as investment tools. You can build wealth, earn dividends, and even access cash while you’re alive. That’s the power of understanding your options.

Who Needs Life Insurance?

You might be wondering, “Do I need life insurance?” Let’s get real.

If someone depends on your income, the answer is a resounding yes. Here’s who typically needs it:

- Parents with Minor Children: You’re responsible for your children’s financial future.

- Couples with Joint Debt: If one of you dies, the other still owes the full balance.

- Business Owners: Life insurance can ensure business continuity.

- Homeowners with Mortgages: Protect your family from losing your home.

- Single Adults with Co-signed Loans: Your death doesn’t cancel the debt.

- Retirees or Pre-Retirees: Final expense policies can cover funeral costs or leave a legacy.

Even stay-at-home parents may need life insurance. Think about the cost of childcare, housekeeping, and more if they weren’t around.

Bottom line? If your absence would create a financial burden for someone, life insurance isn’t a luxury—it’s a necessity.

Types of Life Insurance

Term Life Insurance

This is the most affordable and straightforward type of life insurance. You pay premiums for a set period—typically 10, 20, or 30 years—and if you die during that term, your beneficiaries get the death benefit. If you outlive the term, no benefit is paid (unless you renew or convert the policy).

Why do people love term life?

- Affordable premiums

- Simple and easy to understand

- High coverage amounts are available

- Great for temporary needs (like paying off a mortgage or raising kids)

Let’s look at an example. A healthy 30-year-old could get a $500,000, 20-year term policy for around $20/month. That’s a small price for such a huge peace of mind.

However, once the term expires, coverage ends. If you still want insurance, you may need to reapply, and premiums will be much higher due to age or health changes.

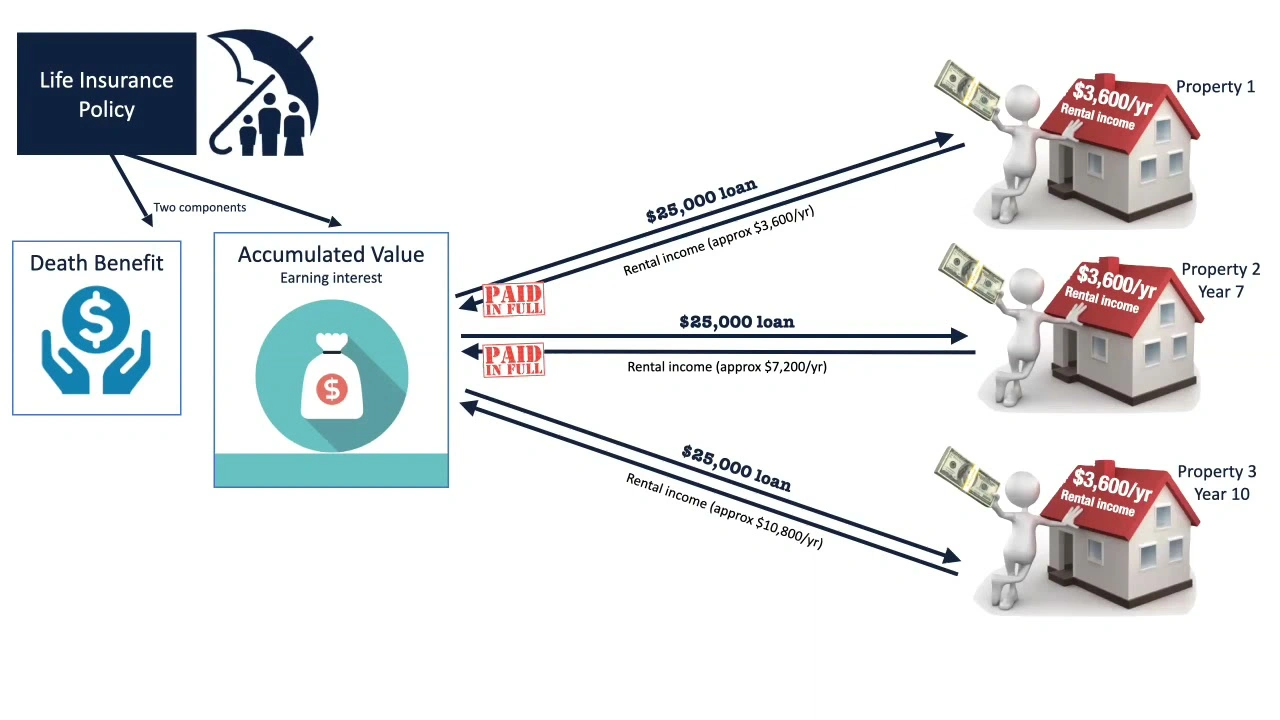

Whole Life Insurance

Whole life is a type of permanent life insurance, meaning it covers you for your entire life, not just a set term. But it doesn’t stop there. Whole life policies also build cash value, which grows over time and can be accessed via loans or withdrawals.

Perks of whole life include:

- Lifetime coverage

- Guaranteed death benefit

- Cash value growth

- Level premiums

But this comes at a cost. Whole life premiums can be 5–10 times higher than term policies for the same coverage amount. So, it’s not for everyone.

Still, for those who can afford it, whole life is a powerful tool. It combines insurance with a savings component and works well for estate planning, wealth building, and leaving a financial legacy.

Universal Life Insurance

Universal Life Insurance (UL) is another form of permanent life insurance, but with a twist—it offers more flexibility than whole life. With UL, you can adjust both your premiums and death benefits over time. That’s right, your policy can grow and shift with your financial situation.

Here’s how it works:

- Flexible Premiums: You can increase, decrease, or even skip payments if there’s enough cash value in the account.

- Adjustable Death Benefit: Want to leave more behind? You can raise the coverage. Tight on money? Lower it.

- Cash Value Component: Grows based on interest rates set by the insurer.

UL insurance is ideal for people who want lifelong coverage but also like to tweak things as life changes. For example, if your income drops during retirement, you can reduce your premium payments temporarily without losing your coverage, as long as the cash value can carry the policy.

However, managing a UL policy requires attention. If you stop paying premiums and your cash value dries up, the policy could lapse. It’s not a “set it and forget it” option, but it’s a great fit for those wanting long-term coverage with more control.

Variable Life Insurance

Now, if you’re financially savvy and not afraid of a little risk, Variable Life Insurance (VLI) could be your cup of tea. This policy combines life insurance with investment opportunities.

Here’s the breakdown:

- Permanent Coverage: Like whole and universal life, VLI lasts your entire life.

- Investment Options: You can allocate the cash value into sub-accounts, similar to mutual funds.

- Cash Value Growth: Depends on the performance of those investments.

But with higher rewards come higher risks. If your investments perform well, your cash value and death benefit can grow significantly. If not, they can shrink. Some policies offer minimum guarantees, but not all do.

VLI isn’t for the faint-hearted. You need to actively monitor the markets or work with a financial advisor. That said, for those who want their insurance policy to also serve as an investment tool, it’s a compelling option.

Final Expense Insurance

Also known as burial insurance, this is a small, whole life policy designed to cover end-of-life expenses—think funeral costs, medical bills, or small debts. Coverage typically ranges from $5,000 to $25,000.

This policy is:

- Easy to get (often no medical exam required)

- Affordable for seniors

- Meant for people who want to avoid burdening their families

It’s especially popular among older adults who don’t need a large death benefit but want to make sure their loved ones don’t have to pay out-of-pocket for final expenses.

While the premiums may seem high for the coverage amount, they’re fixed for life. It’s a great peace-of-mind policy for those in retirement.

Components of a Life Insurance Policy

Premiums

Your premium is the price you pay for your life insurance coverage. Think of it as your monthly subscription to financial peace of mind. But how much you pay depends on several factors:

- Type of policy (term vs. permanent)

- Amount of coverage

- Your age and health

- Lifestyle habits (smoking, risky hobbies)

- Gender

For instance, a healthy 30-year-old non-smoker might pay $20 a month for a $500,000 term policy. That same person might pay $200/month for a whole life policy.

Permanent policies usually cost more because they offer lifetime coverage and a cash value component. But the premium is locked in—no surprise rate hikes.

It’s important to pay your premiums on time. Miss too many, and your policy can lapse, leaving your loved ones unprotected.

Death Benefit

The death benefit is the tax-free money your beneficiaries receive when you pass away. This is the core of your policy—the reason you bought it in the first place. It’s your final gift to the people you love.

You get to choose how much coverage you want, usually anywhere from $50,000 to several million dollars. The amount you choose should be enough to:

- Replace your income for several years

- Pay off major debts

- Cover education costs

- Handle final expenses

Some policies even allow for accelerated death benefits. If you’re diagnosed with a terminal illness, you can access part of your death benefit early to cover medical or living costs.

Choosing the right amount of coverage isn’t just about what you can afford—it’s about what your family will need. Too little, and they might struggle. Too much, and you might be overpaying. Aim for a balance that gives peace of mind.

Policy Term and Riders

The policy term is how long your life insurance coverage lasts. With term life, it’s usually 10, 20, or 30 years. With permanent life, it’s lifelong, as long as you pay your premiums.

Now, let’s talk about riders. These are optional add-ons that customize your policy. Think of them like extra toppings on your insurance pizza.

Popular riders include:

- Waiver of Premium: If you become disabled, your premiums are waived.

- Accidental Death: Pays extra if death is due to an accident.

- Child Term Rider: Covers your children under your policy.

- Return of Premium: Refunds your premiums if you outlive the term.

Riders can make a basic policy much more powerful, especially when tailored to your life situation. Some cost extra, while others are included. Make sure to read the fine print and ask your insurer about options.

How to Choose the Right Life Insurance Policy

Assessing Your Financial Needs

Choosing the right life insurance policy starts with a simple, yet powerful question: What would happen to your family if you weren’t around tomorrow? The answer helps you figure out how much coverage you need.

Start by calculating your current and future financial obligations. This includes:

- Outstanding debts (mortgage, loans, credit cards)

- Daily living expenses for your family

- College tuition or education funds for your kids

- Final expenses (funeral costs, medical bills)

- Income replacement (how many years would they need?)

Now subtract any assets your family could fall back on—like savings, investments, or other insurance policies.

Let’s say you earn $60,000 per year and want to provide that income for the next 10 years. That’s $600,000. Add $150,000 for your mortgage and $50,000 for education. That’s a total of $800,000 in coverage needed. Round up for inflation and unexpected costs.

Pro tip: Many financial advisors recommend life insurance coverage of 10–15 times your annual income.

Also, consider your stage in life. A young parent with small kids may need a longer term and larger benefit than a single 50-year-old nearing retirement. Customization is key here—what’s “right” for one person may not suit another.

Comparing Policy Types

Now that you know your financial needs, the next step is choosing the right type of policy. Should you go with affordable term insurance? Or a permanent policy that builds value? Let’s compare the options.

| Feature | Term Life | Whole Life | Universal Life | Variable Life |

| Duration | Temporary (10-30 yrs) | Permanent | Permanent | Permanent |

| Premiums | Low | High | Flexible | High/Variable |

| Cash Value | No | Yes | Yes | Yes |

| Investment Option | No | No | Limited | Yes |

| Flexibility | Low | Moderate | High | High (but risky) |

- Choose Term if you want affordable, simple coverage during your high-responsibility years (raising kids, paying off a mortgage).

- Choose Whole if you want lifelong protection and guaranteed cash value.

- Choose Universal for flexibility and lifelong coverage.

- Choose Variable if you’re comfortable with investment risk and want potential for higher growth.

Each type has its pros and cons. It all comes down to your budget, financial goals, and risk tolerance.

Evaluating Insurance Providers

Not all insurance companies are created equal. Some are rock-solid with decades of experience and excellent customer service. Others may have shaky financials or complicated claim processes.

Before you sign anything, check the following:

- Financial Strength Ratings: Use services like AM Best, Moody’s, or Standard & Poor’s. Look for “A” ratings or higher.

- Claim Settlement Ratio: A high ratio means the company pays out claims reliably.

- Customer Reviews: What are people saying about service, communication, and claims support?

- Policy Options: Do they offer the type of policy you want with the riders you need?

- Cost Transparency: Are there hidden fees? Can you see detailed breakdowns of premiums and benefits?

You want a company that will be there for your family when it matters most, not one that disappears or delays payouts. Stick to reputable, established insurers with a strong record of honoring claims.

And don’t be afraid to shop around. Get quotes from at least three providers. It could save you thousands over the life of the policy.

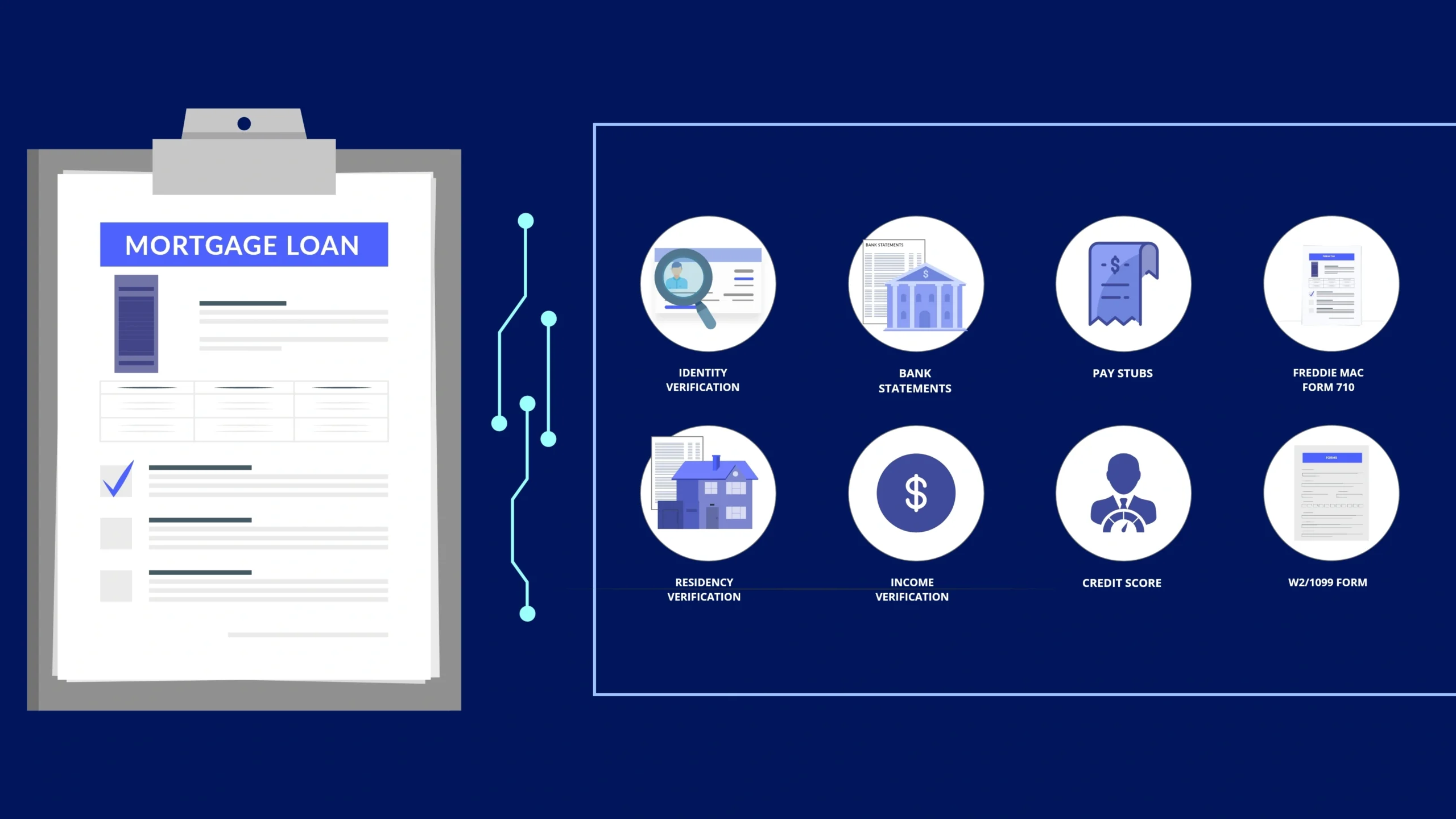

The Application and Underwriting Process

What Insurers Look For

When you apply for life insurance, the insurer assesses your risk. Their goal? To figure out how likely it is that they’ll have to pay out your death benefit. This process is called underwriting, and it influences your premium rate.

Here’s what they’ll evaluate:

- Age: The younger you are, the cheaper your policy.

- Gender: Women generally live longer, so they often pay less.

- Health History: Chronic illnesses, medications, surgeries—all come into play.

- Lifestyle: Smokers, heavy drinkers, and thrill-seekers pay more.

- Occupation: Dangerous jobs (firefighters, pilots, construction workers) may mean higher premiums.

- Family Medical History: Hereditary risks can influence underwriting decisions.

Some insurers also ask about travel habits, hobbies (like scuba diving or skydiving), and even your credit history. It might seem intrusive, but it’s how they measure risk.

After reviewing your application, they assign you a risk class, like Preferred Plus, Standard, or Substandard. Your class determines your final premium.

The better your health and lifestyle, the better your class and the lower your rates. So it pays—literally—to be healthy and honest.

Medical Exams and Questionnaires

Depending on the type and amount of coverage you’re applying for, you might be asked to undergo a medical exam. This isn’t like a full-blown checkup—think of it more like a mini physical.

It usually includes:

- Blood pressure check

- Blood and urine samples

- Height and weight measurement

- Review of medical history

Some insurers send a nurse to your home or office. The whole thing takes 30 minutes or less.

But here’s the good news: Many companies now offer no-exam policies. These are especially common for:

- Term policies under $500,000

- Younger applicants with good health

- Final expense or simplified issue policies

Instead of a physical, you answer health-related questions on a form. These policies cost a bit more, but they’re fast approved in days instead of weeks.

If you’re in great health, doing the medical exam can save you big bucks over the long haul. But if you’re in a hurry or don’t want the hassle, no-exam life insurance is a great alternative.

Benefits of Having Life Insurance

Financial Security for Your Family

Imagine your loved ones dealing with emotional pain, and then facing a financial crisis on top of it. That’s where life insurance becomes a financial superhero. It steps in at the worst possible time and says, “I’ve got this.”

When you have life insurance, you’re providing a financial cushion that can:

- Replace lost income

- Pay for your children’s education

- Cover mortgage payments and household bills

- Keep your family from needing to relocate or downsize

- Allow a surviving spouse to retire comfortably

That’s powerful. It’s not just about the numbers—it’s about stability and dignity during life’s most uncertain moments.

For many families, that death benefit becomes the bridge between financial devastation and continued security. It helps them grieve without having to worry about how to survive financially.

Peace of Mind

Let’s be real: death is uncomfortable to talk about. But preparing for it isn’t just responsible—it’s liberating. When you’ve got a solid life insurance policy in place, you can sleep easier knowing your family is protected.

This peace of mind is priceless. You know that if anything happens, your loved ones won’t have to scramble, beg for help, or dip into their savings. They can focus on healing, not hustling.

Even more, it changes the way you live. You can plan with more confidence, take some financial risks, and build your future without worrying that it all falls apart if something happens to you.

Wealth Transfer and Estate Planning

Life insurance isn’t just for paying bills—it’s also a smart estate planning tool. If you’ve built up assets, life insurance can help ensure that more of it goes to your heirs instead of to Uncle Sam.

Here’s how:

- Tax-Free Payouts: Death benefits are usually not subject to income tax.

- Liquidity for Estate Taxes: If your estate is large and taxable, the insurance payout can help heirs pay the IRS without selling assets.

- Equalizing Inheritances: Got a business or property you want to leave to one child but not the other? A policy can provide cash to the other, making it fair.

High-net-worth individuals often use life insurance in trusts or other legal strategies to pass wealth efficiently and privately. It can be an elegant solution to some very complex estate issues.

Conclusion

Life insurance might not be the most exciting thing to talk about, but it’s one of the most important decisions you can make for your family’s future. It’s not about fear—it’s about love. It’s about taking responsibility today, so your loved ones don’t have to face tomorrow alone.

Whether you’re a new parent, a business owner, or just someone who wants to leave a lasting legacy, there’s a life insurance policy that fits your needs. From affordable term plans to comprehensive permanent options, the right coverage offers peace of mind and financial security.

Talk to an advisor. Get some quotes. Ask questions. And most importantly, put that protection in place. Because life is unpredictable, but your family’s future doesn’t have to be.

FAQ

Is life insurance taxable?

In most cases, life insurance payouts are not taxable. Beneficiaries receive the death benefit tax-free. However, interest earned or policies with investment components may have taxable elements.

Can I have more than one life insurance policy?

Yes, many people have multiple policies. You might start with a small employer-sponsored plan and later buy a larger term policy for your family. It’s legal and sometimes recommended to layer coverage.

What happens if I outlive my term life insurance?

Your coverage ends unless you renew or convert the policy. Some policies offer a return of premium option, but most do not. You’ll need to reapply for new coverage if needed.

Do I need life insurance if I’m single with no kids?

Maybe not, but it depends. If you have co-signed debts, aging parents, or someone who would be financially impacted by your death, it’s worth considering. Also, locking in low rates early is smart.

How much life insurance do I need?

A common rule of thumb is 10–15 times your annual income. But it’s better to do a needs-based analysis considering debts, income replacement, future expenses, and current assets.