Short-term health insurance, also known as gap coverage or temporary health insurance, provides temporary medical coverage outside of Open Enrollment. It offers a more affordable option than comprehensive health insurance plans. Short-term plans are designed for individuals who don’t have permanent health coverage during periods when they aren’t eligible for other plans.

What is Short-Term Health Insurance?

Short-term health insurance (also known as temporary health insurance or short-term medical insurance) is a type of limited-duration coverage designed to help you during a transition period in your life. These plans typically last for a few months, up to a maximum of 12 months in many states, with the option to renew for up to 36 months in some cases. They are not meant to be a replacement for long-term, comprehensive health insurance but serve as a safety net when you’re temporarily uninsured.

Short-Term Health Insurance Coverage

Short-term health insurance is a temporary coverage solution designed to bridge gaps when you’re between major medical plans. It provides limited, fast-acting protection for unexpected illnesses or injuries. While not a substitute for long-term health insurance, it offers peace of mind during uncertain periods.

1. Transition Coverage: Life transitions often come with gaps in health coverage. Whether you’re switching jobs, graduating from college, retiring early, or aging out of a parent’s plan, you might find yourself temporarily uninsured. Short-term health insurance offers quick and affordable coverage that can begin within 24 hours of application. This makes it a smart choice for those in-between periods when you need basic health protection but don’t yet qualify for a long-term plan. These policies usually last from 30 days to 12 months, with renewals allowed up to 36 months in some states.

2. Gap Solution: Short-term insurance is an effective gap solution when other health plans aren’t available. If you missed Open Enrollment and don’t qualify for a Special Enrollment Period under the Affordable Care Act (ACA), short-term plans can help fill that void. While they don’t meet ACA requirements or cover essential health benefits like preventive care or maternity, they do cover emergency room visits, hospital stays, and certain doctor visits. It’s a temporary safety net—not comprehensive coverage—ideal for healthy individuals who need protection against major medical events while they wait for a long-term plan to begin.

3. Limited Coverage: It’s important to understand that short-term health insurance offers limited coverage. These plans do not cover pre-existing conditions, mental health services, or most prescription medications. They also exclude maternity, preventive care, and immunizations. Deductibles and out-of-pocket costs are typically higher compared to ACA-compliant plans. Because they are not regulated under the same guidelines, insurers can deny coverage based on medical history. While the premiums are lower, you’re trading affordability for reduced benefits and protections. Always review the policy terms carefully to avoid surprises when you need care.

4. Short-Term Health Insurance: Short-term health insurance serves a clear purpose: to offer basic, temporary medical coverage during life’s transitions. It’s not for everyone, but for those who are healthy, under 65, and in need of a short-term solution, it can be a valuable tool. Choose your plan wisely based on coverage duration, provider network, and what’s included—and always be aware of state regulations, as availability varies. Ultimately, short-term health insurance is a flexible option for bridging coverage gaps without long-term commitment or high costs.

Who Should Consider Short-Term Health Insurance?

Short-term plans are ideal for:

- People are between jobs or waiting for employer coverage to start

- Recent college graduates

- Early retirees who aren’t yet eligible for Medicare

- People who missed Open Enrollment and don’t qualify for a Special Enrollment Period

- Those waiting for Medicare coverage

- Individuals coming off their parents’ plan after turning 26

- Temporary workers or freelancers without employer benefits

Here are the main characteristics that define short-term health plans:

1. Limited Coverage Duration: Most short-term plans cover you for 30 days up to 12 months. In some states, they can be renewed for up to 36 months, but not all states allow extensions.

2. Low Monthly Premiums: Short-term plans are much cheaper than ACA-compliant plans because they offer limited coverage and exclude pre-existing conditions.

3. No Guaranteed Coverage: Unlike ACA plans, short-term health insurance doesn’t guarantee acceptance. Insurers can deny coverage based on health history.

4. Fast Approval: You can often get coverage within 24 hours of applying. This makes them ideal for urgent situations.

5. Limited Benefits

These plans generally cover:

- Emergency services

- Some doctor visits

- Hospital stays

- Surgery

They do not usually cover:

- Pre-existing conditions

- Maternity care

- Prescription drugs (except in emergencies)

- Mental health services

- Preventive care

Pros and Cons of Short-Term Health Insurance

Here’s a balanced look at the advantages and disadvantages of temporary health insurance:

✅ Pros

- Affordable premiums: Lower monthly cost compared to ACA plans

- Flexible terms: Choose the duration that fits your situation

- Quick coverage: Often starts the next day

- Wide provider network: More doctors and hospital choices

- Easy application: No long waiting or complex paperwork

❌ Cons

- Limited benefits: Doesn’t cover everything

- No pre-existing condition coverage

- Doesn’t meet ACA requirements

- Not renewable in some states

- High deductibles and out-of-pocket costs

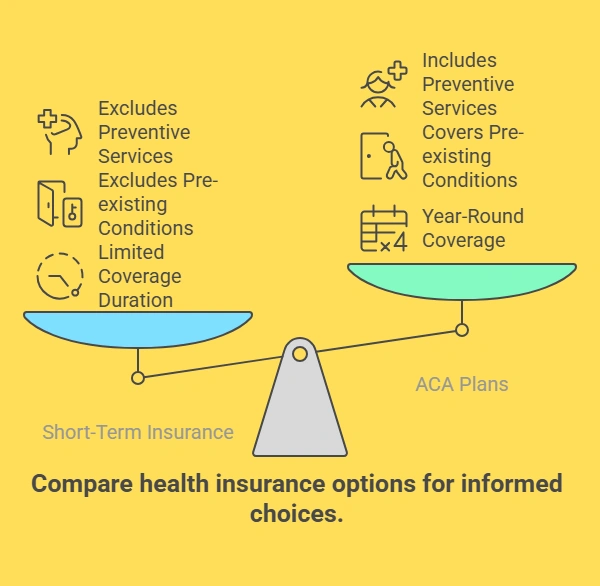

How is Short-Term Health Insurance Different from ACA Plans?

Let’s compare short-term health insurance vs. ACA (Affordable Care Act) plans:

| Feature | Short-Term Insurance | ACA Plans (Marketplace) |

| Coverage Duration | Up to 12 months (renewable) | Year-round |

| Pre-existing Conditions | Not covered | Always covered |

| Preventive Services | Often excluded | Always included |

| Mental Health | Rarely covered | Always included |

| Maternity | Not covered | Always covered |

| Cost | Lower premiums | Higher, but subsidies may apply |

| Enrollment Period | Anytime | Limited Open Enrollment |

| Government Subsidy | Not eligible | Eligible based on income |

What Do Short-Term Health Plans Typically Cover?

Every provider is different, but here’s a general idea of what’s usually included:

Covered:

- Emergency room visits

- Inpatient and outpatient hospital care

- Doctor’s visits

- Limited surgery services

- Diagnostic services like X-rays and lab tests

Not Covered:

- Routine checkups

- Immunizations and screenings

- Pregnancy and maternity care

- Prescription drugs (in many plans)

- Dental and vision

- Pre-existing conditions

How Much Does Short-Term Health Insurance Cost?

The average monthly premium for a short-term plan ranges from $60 to $250, depending on:

- Age

- Gender

- Location

- Coverage length

- Deductibles and co-pays

- Insurance provider

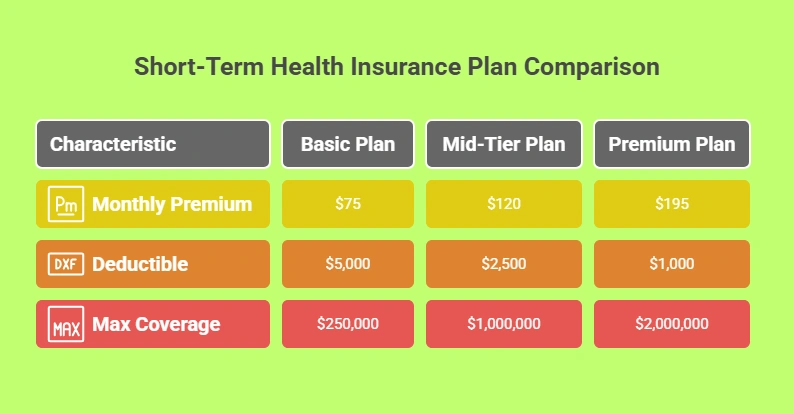

Here’s a sample breakdown for a healthy 30-year-old male:

| Plan Type | Monthly Premium | Deductible | Max Coverage |

| Basic Plan | $75 | $5,000 | $250,000 |

| Mid-Tier Plan | $120 | $2,500 | $1,000,000 |

| Premium Plan | $195 | $1,000 | $2,000,000 |

Which States Allow Short-Term Health Plans?

Not every state allows short-term health insurance. As of now:

States That Allow Up to 36 Months:

- Texas

- Florida

- South Carolina

- Arizona

- Utah

- Oklahoma

States That Restrict Short-Term Plans:

- California (banned)

- New York (banned)

- Massachusetts

- New Jersey

- Rhode Island

Is Short-Term Health Insurance Worth It?

It depends. If you’re healthy, between coverage, and just need something to protect you from unexpected accidents or illnesses, short-term insurance can be a smart financial move. But if you need ongoing care, have pre-existing conditions, or require medications, then an ACA-compliant plan is likely the better choice, even if it costs more.

Conclusion

Short-term health insurance offers temporary, affordable coverage during life transitions. While it lacks comprehensive benefits, it’s a practical option for healthy individuals needing gap protection. Always compare plans, understand limitations, and ensure it fits your needs before choosing this type of health coverage.

This term offers a quick, affordable way to stay covered during life transitions. While it doesn’t provide all the protections of long-term plans, it can still be a valuable option if you understand its limitations. Always shop around, compare quotes, and read the fine print. And if you’re unsure, speak to a licensed health insurance agent who can guide you based on your needs and state regulations.

FAQ

What is the meaning of short-term health insurance?

Short-term health insurance is temporary medical coverage designed to fill gaps during life transitions, such as job changes or waiting periods. It offers limited protection for unexpected illnesses or injuries, typically lasting from one month up to a year, depending on state regulations.

What does short-term insurance cover?

Short-term insurance typically covers emergency care, hospital stays, doctor visits, and some surgeries. It often excludes pre-existing conditions, preventive services, maternity, and prescriptions. Coverage varies by provider, so it’s important to review policy details to understand exactly what benefits are included.

What is the downside to short-term health insurance?

The main downsides include limited benefits, no coverage for pre-existing conditions, high deductibles, and a lack of preventive care or mental health services. It doesn’t meet ACA standards and may leave you financially exposed in case of major or ongoing medical issues.

Is short-term insurance a good idea?

Short-term insurance can be a smart option for healthy individuals needing temporary coverage during gaps. However, it’s not ideal for those with ongoing medical needs due to limited benefits. Evaluate your health status and coverage needs before choosing this type of plan.