Business insurance provides financial protection to businesses against various risks such as property damage, liability claims, and employee injuries. It encompasses policies like general liability, property insurance, and workers’ compensation, helping businesses mitigate potential losses and maintain financial stability.

What is business insurance?

Business insurance is a type of coverage that safeguards organizations from monetary misfortunes because of startling occasions. It ordinarily incorporates approaches like general risk, property protection, and laborers’ remuneration.

Business protection mitigates gambles related to property harm, legitimate liabilities, and worker wounds. By paying expenses, organizations guarantee they’re monetarily safeguarded against unexpected conditions, permitting them to zero in on their activities without agonizing over critical monetary difficulties.

Do businesses need insurance?

Yes, businesses typically need insurance to safeguard their operations against various risks. Insurance protects against property damage, liability claims, employee injuries, and other unforeseen events. With insurance, businesses can avoid substantial financial losses that could jeopardize their viability.

Additionally, many contracts and agreements require businesses to carry specific types of insurance as a condition of doing business. Moreover, having insurance can enhance credibility and trust among customers, partners, and investors.

While the specific insurance needs vary depending on the industry, size, and nature of the business, having adequate coverage is essential for protecting assets, ensuring continuity, and mitigating potential liabilities.

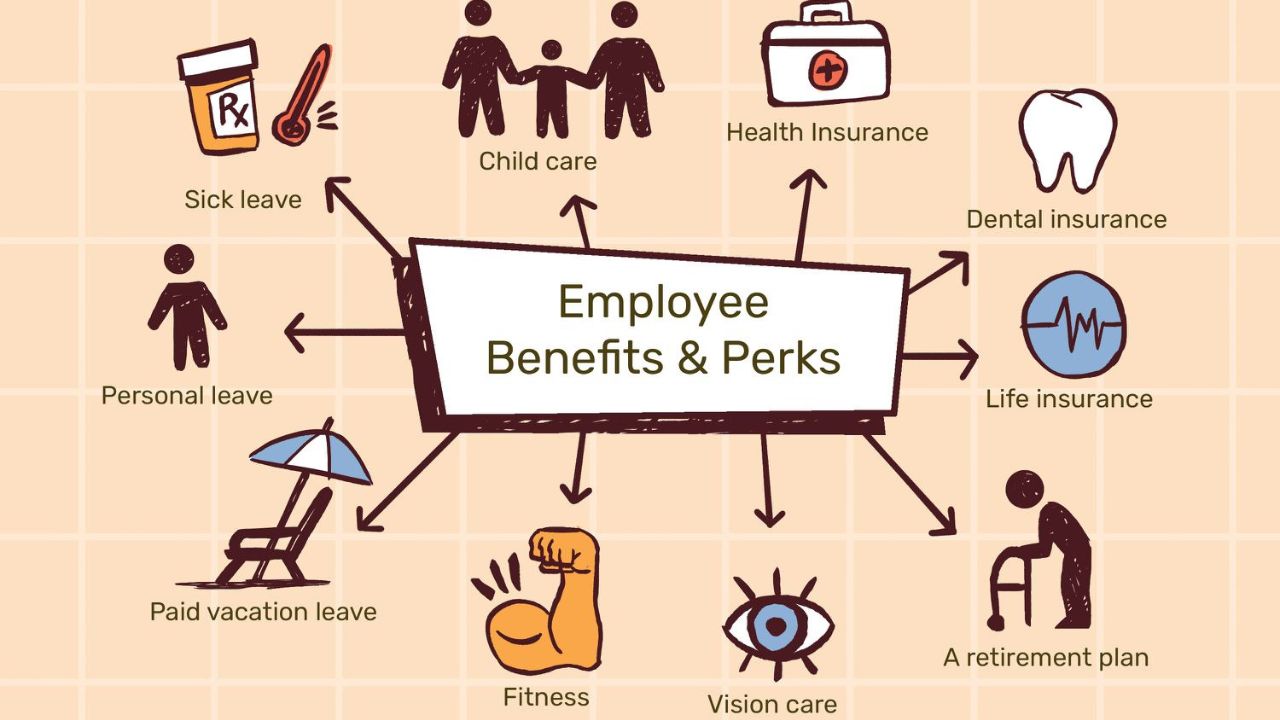

What are the different types of business insurance?

General liability: General liability insurance protects businesses from monetary misfortunes because of outsider cases of real injury, property harm, or promoting injury. It takes care of legitimate expenses, settlements, and clinical costs, assuming somebody sues your business for mishaps on your property or because of your tasks. This protection is fundamental for safeguarding against claims and guaranteeing the monetary soundness of your business.

Professional liability: Professional liability insurance, generally called botches and oversights security, safeguards specialists from money related disasters coming about as a result of recklessness, slip-ups, or prohibitions in their organizations. It covers legitimate charges, settlements, and choices if a client sues for lacking work, missed deadlines, or other master slips. This assurance is vital for specialists like legitimate counselors, trained professionals, specialists, and planners, giving internal tranquility and money-related protection against anticipated liabilities.

Workers’ compensation: Workers’ compensation insurance provides coverage costs and lost compensation if they experience a business related injury or sickness. It likewise safeguards businesses from claims recorded by harmed representatives. This protection is obligatory in many states and guarantees that workers get vital clinical consideration and monetary help without suing their managers. It likewise gives a security net to organizations against expensive fights in court.

Commercial property insurance: Commercial property insurance protects businesses against monetary misfortunes because of harm or loss of their actual resources, like structures, gear, stock, and decorations. It covers risks like fire, burglary, defacing, and cataclysmic events. This protection guarantees that organizations can fix or supplant harmed property, limiting interruptions to activities and assisting them with recuperating rapidly from surprising occasions that could cause huge monetary strain.

Commercial auto insurance: Commercial auto insurance covers vehicles utilized for business motivations, including organization vehicles, trucks, and vans. It safeguards organizations from monetary misfortunes because of mishaps, robbery, defacing, and other harms, including their business vehicles. This protection ordinarily covers responsibility for substantial injury and property harm, crashes, and far-reaching inclusion for harm to the safeguarded vehicles. Fundamental organizations depend on vehicles for activities.

How much does small business insurance cost?

Small business insurance costs vary depending on factors such as the type of coverage, business industry, location, size, and risk factors. On average, small businesses can expect to pay anywhere from a few hundred to several thousand dollars annually for insurance coverage. Working with an insurance agent can help determine specific costs tailored to your business needs.

Factor 1: Number of employees

The number of employees significantly influences the cost of small business insurance. Generally, the more employees a business has, the higher the premiums tend to be. This is because a larger workforce typically increases the risk of workplace accidents or injuries, which can result in higher claims and liabilities for the insurance provider.

Factor 2: Location, location, location

Another crucial factor affecting small business insurance costs is the business’s location. Insurance rates can vary significantly depending on factors such as the local crime rate, weather risks (like hurricanes or earthquakes), and the prevalence of certain industries in the area. Urban areas or regions prone to natural disasters may have higher insurance premiums due to increased risks of property damage or liability claims.

Factor 3: Your industry

The industry in which a small business operates also heavily influences insurance costs. Certain industries are inherently riskier than others, leading to higher insurance premiums. For example, construction companies or medical practices typically face greater liability risks than retail stores or consulting firms. Insurance providers assess the specific risks associated with each industry and adjust premiums accordingly to reflect the level of risk exposure.

Factor 4: Scope of operations

The scope of a business’s operations is a critical factor impacting insurance costs. Insurance premiums are often influenced by the size and complexity of a company’s activities. For instance, a business with multiple locations, extensive product lines, or a wide range of services may face higher premiums due to increased exposure to potential risks. Insurers consider the breadth and diversity of operations when calculating coverage rates.

Factor 5: Experience

The level of experience a business has can also affect insurance costs. Insurance providers may consider factors such as the length of time the business has been operating, its claims history, and any previous insurance coverage. A business with a long track record of safe operations and few or no past insurance claims may qualify for lower premiums, reflecting the reduced perceived risk to the insurer.

How NEXT helps small businesses get the right coverage

NEXT helps small businesses find the right insurance coverage by offering personalized solutions tailored to their needs. Through a streamlined online platform, NEXT provides access to a wide range of insurance providers and policy options, simplifying the comparison and selection process.

Small business owners receive customized insurance quotes from multiple providers by inputting key information about their business, such as industry, location, and size. Additionally, NEXT’s team of experts is available to provide guidance and support, helping businesses understand their coverage options and make informed decisions.

With transparent pricing and clear policy details, NEXT empowers small businesses to secure protection against potential risks and liabilities. By leveraging technology and expertise, NEXT makes the insurance procurement process efficient, transparent, and tailored to the unique requirements of each small business.

Six common types of business insurance

1. General liability insurance

General liability insurance protects businesses from financial losses from third-party claims of bodily injury, property damage, or advertising injury. It covers legal expenses, settlements, and medical costs if someone sues the business for accidents occurring on its premises or as a result of its operations. This insurance is essential for shielding businesses from costly lawsuits and ensuring their financial stability by covering a wide range of potential liabilities.

2. Product liability insurance

Product liability insurance protects businesses from financial losses from third-party claims of injury or property damage caused by products they manufacture or sell. It covers legal fees, settlements, and medical expenses if someone sues the business for injuries or damages caused by a defective or unsafe product. This insurance is crucial for product-based businesses to mitigate the risks associated with potential product defects and liability claims.

3. Professional liability insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals from financial losses due to claims of negligence, errors, or omissions in their professional services. It covers legal fees, settlements, and judgments if a client sues for mistakes or inadequate work. This insurance is essential for professionals such as lawyers, consultants, and accountants, providing protection against potential lawsuits and safeguarding their reputation and finances.

4. Commercial property insurance

Commercial property insurance protects businesses against financial losses from damage or loss of their physical assets, including buildings, equipment, inventory, and furnishings. It covers perils such as fire, theft, vandalism, and natural disasters. This insurance ensures businesses can repair or replace damaged property, minimizing operational disruptions and financial strain. It is essential for safeguarding a company’s tangible assets and maintaining business continuity in the face of unexpected events.

5. Home-based business insurance

Home-based business insurance provides coverage for businesses operated from a home. It typically includes protections in standard business policies, such as general liability, property, and professional liability insurance. This insurance covers business-related equipment, inventory, and liability risks not covered by homeowner’s insurance. It ensures that home-based entrepreneurs are protected against financial losses due to property damage, accidents, or lawsuits related to their business activities, offering peace of mind and financial security

6. Business owner’s policy

A Business Owner’s Policy (BOP) combines essential business insurance coverages into a single package. Typically, it includes general liability, commercial property, and business interruption insurance. A BOP protects against financial losses from property damage, third-party claims, and income loss due to covered events. It is designed for small—to medium-sized businesses, offering comprehensive coverage at a lower cost than purchasing separate policies. It simplifies the insurance process while ensuring broad protection.

Four steps to buy business insurance

- Assess your risks: Start by recognizing the particular dangers related to your business. Consider potential liabilities, such as property harm, worker wounds, and lawful cases. Understanding these dangers decides the kinds of protection you really want, like general risk, property protection, or expert responsibility protection.

- Find a reputable licensed agent: Work with a licensed insurance agent or broker specializing in business insurance. A knowledgeable agent can provide expert advice, help you navigate the complexities of insurance policies, and ensure you get the right coverage for your business needs. Choose an agent with a good reputation, positive client reviews, and relevant experience in your industry.

- Shop around: Obtain quotes from multiple insurance providers to compare coverage options and prices. Different insurers offer varying levels of coverage and premiums, so it’s crucial to evaluate several options to find the best fit for your business. Ensure the quotes are based on similar coverage limits and deductibles for an accurate comparison.

- Re-assess every year: Business needs and risks evolve, so it’s important to review your insurance coverage annually. Re-assess your risks, consider any changes in your business operations, and adjust your coverage as necessary. Regularly updating your insurance ensures that you maintain adequate protection and avoid potential gaps in coverage.

Conclusion

Business insurance is essential for safeguarding any business’s financial stability and longevity. Whether you’re seeking small business insurance to protect your growing enterprise or looking for the best business insurance for an LLC, finding the right coverage tailored to your needs is crucial.

Obtaining a business insurance quote from multiple providers allows you to compare options and secure the best possible deal. Resources like Business Insurance Magazine offer valuable insights and updates on industry trends and best practices.

It is important for businesses operating in regions like California to understand local regulations and risks to ensure comprehensive coverage. Additionally, while searching for cheap business insurance, ensure that affordability does not compromise the quality of protection. By carefully selecting the right policies, businesses can effectively manage risks and focus on growth and success.

FAQ

What is the best type of insurance for a small business?

The best insurance for an independent company is an Entrepreneur’s Contract (BOP). It combines general responsibility, property protection, and business interference coverage into one complete bundle, giving fundamental assurance against normal dangers at a reasonable expense.

What insurance do I need to run my own business?

To maintain your business, you commonly need general responsibility protection, property protection, and laborers’ remuneration protection, assuming you have representatives. Contingent upon your industry, you could require proficient responsibility insurance or an Entrepreneur’s Contract (BOP) for exhaustive inclusion.

How much is a $2 million dollar insurance policy for a business?

The expense of a $2 million insurance contract for a business fluctuates generally based on elements like industry, area, and hazard level. Overall, expenses can go from $500 to $3,000 yearly, except acquiring explicit statements from insurers is ideal.

What type of insurance is sold to small businesses?

Independent companies offer a few kinds of insurance, including general responsibility protection, property protection, laborers’ pay protection, proficient obligation protection, business accident protection, and entrepreneur’s contracts (BOPs). These arrangements offer insurance against different dangers and liabilities ordinarily faced by private ventures.

Is business insurance tax deductible?

Indeed, business insurance payments are generally charged deductible as normal and vital business costs. Nonetheless, the deductibility might differ depending on the particular sort of protection and the guidelines in your jurisdiction. It’s fitting to talk with an expense proficient for precise direction regarding deductibility.

What is a small business in insurance?

In insurance, a private company ordinarily alludes to ventures with somewhat low incomes, fewer workers, and fewer broad tasks compared with bigger enterprises. Independent companies might have exceptional protection needs and frequently require specific inclusion customized to their size and industry.